I don't think a tradable bottom is in place, sufficient demand at current prices has not shown up IMHO. It may not be until normal cyclical lows made in Sept/Oct time frame. This I might ride into Dec and then skeedaddle until MArch.

Think about the action in the Dow, has it been bullish? higher highs? lows?

With extreme prices being paid in energy, and NO relief that can be seen, inflation is more than on our doorstep. And higher oil trickles down into almost everything we buy or need.

Dollar is soaring today, news reports say it's because of middle east unrest, imagine that the US $$$ as safe haven...LOL gues they do not care about the $trillions in debt and unfudned liabilities? Gold off in reaction.

So, we have an engine, in ASIA some have called CHINDIA (complete investor) that is gaining spedd and horsepower and is insatiable in its growing deamnd to feed....consume natural resources, this may be unstoppable unavoidable and the result could be a doubling in energy consumption in 10 years! HOW is this demand going to be met?

We are ill prepared and not moving FAST enough to deal with these andmany other issues. We have a puppet at the helm we only get lip service from.

Ford comes out with 500 HP Mustang, neat huh? SUV'S roam the land, Hummers on every street, it isnt that they can't afford the gas, it is the rate of consumption that is the problem, gas mileage MUST increase, conservation, more diesel engines, new fuels and technology.

Lots of talk about ETAHNOL, but it is nt very efficient, and it takes lots of POWER to produce, pesticides etc, sugar cane is more reasonable source, of which the US has none. INstead we put tarrif on incoming Ethanol and add a SUBSIDY you and I pay for towards US produced Ethanol, Ethanol cannot stand on its own without 50 Cent gal subsidy, again you and I pay.

My moving average work tells me NAZ is in bear market again, with the DOW and SPX VERY close, but no signal yet. But one thing seems very clear to me, the demand for stocks is dwindling while supply increases, this is setting us up for a big mistake. And we just had 3 staright triple digit losses.

Lemmings are staying put for now, and I still expect a nice rally from lows in Fall into year end, but that will only be a temporary lull before more increased selling action returns.

It seems like a NO BRAINER to invest in oil and energy related stocks here, you see it on every magazine cover, Peak OIL stories abound, "we are running out of oil"....WHO doesn't think oil is just going to keep going up?

And that is what bothers me, contrarian as I am, it seems too easy. TOO many people think this is true.

I agree no new oil discoveries of significance have been found in last 10 years. Demand from China and India is growing exponentially, these are all real situations.

My gut tells me a correction is coming and if I was wanting to add for start positions, this is what I might look for. Gold and OIL charts look like bull markets, so good chance of higher highes down the road.....but you always get bull corrections too.

When wanting a position in something, it is sometimes a good idea to ease into it, 1/3 a 1/3 and if trend is solid all in the amount you have decided you can risk, and an exit strategy.

Not every trade will be a winner, even if based on sound theory, so it is key to keep your losses small. It is NOT so important to be stubborn and be proven right. The best make mistakes all the time, it is just when they ARE right it is in big way.

COULD HIGH ENERGY prices, inflation, weak hosuing market, and FED rate increases all conspire to cause a Recession?

I think so, and wouldn't a world slowdown, weaken demand for oil? With lots of supply meeting current demand, if demand slackens, won't prices tumble?at least temporarily?

Things are getting VERY interesting, and troubling, stay tuned.

Duratek

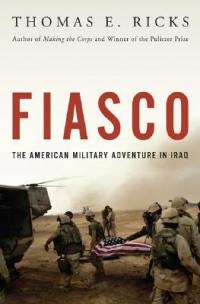

BuzzFlash.com's Review (excerpt)

BuzzFlash.com's Review (excerpt)