Thursday, August 31, 2006

YELLOW BRICK ROAD

The argument for RAMPANT inflation driving gold like in the 70's is not a valid argument, bond yields dont back it up. $70 PLUS oil has NOT produced what HIGH oil did back then, because of ASIAN producers.

Housing prices are "deflating". The world banks are tightening. NO ONE talks of delfation, barely even Precther. What we have is STAGFLATION. We are NOT in Goldilocks -land, we either get one evil or the other.

When the IMPACT of the bursting HOME BUBBLE is realized............the exits will be JAMMED with lemmings of the likes you have never seen before

Wednesday, August 30, 2006

Oil is Near RECORD Highs Still BUT

Something does not add up my friends. This is NOT what you think you'd see? in these related firms? and COAL???

Duratek

GDP LOWER

WASHINGTON (Reuters) - The U.S. economy grew at a 2.9 percent annual pace in the second quarter, faster than originally reported but less of an upward revision than expected, as higher business investment offset a drop in residential construction, a Commerce Department report showed on Wednesday.

Analysts polled by Reuters were expecting the second pass at GDP estimates for the April-June quarter to be revised up to a 3 percent annual pace from the initial 2.5 percent estimate for the quarter released last month.

Even so, excluding the Hurricane Katrina-affected final quarter of last year, it was the slowest quarterly U.S. growth pace since a 2.6 percent gain in the fourth quarter of 2004 on the biggest decline in homebuilding in more than ten years.

An inflation gauge favored by the Federal Reserve - a measure of personal consumption expenditure prices minus food and energy - was revised slightly downward to a 2.8 percent gain from an originally reported 2.9 percent rise. The last time there was an equivalent rise in the category was in the first quarter of 2001.

Businesses spent more on buildings, plants and factories than originally thought in the second quarter. The 22.2 percent rise was the biggest gain in nonresidential fixed investment in structures since the second quarter of 1994.

However, in a sign the housing sector is cooling rapidly, investment on residential structures fell 9.8 percent, the biggest decline since a 12.2 percent fall in the second quarter of 1995, the Commerce Department said.

Investment in inventories, exports, and spending by state and local governments were also higher than first thought.

But business investment in equipment and software was revised to a larger decline of 1.6 percent, the biggest drop since the fourth quarter of 2002.

Corporate profits after taxes rose 2.1 percent in the second quarter, a much smaller gain than the 14.8 percent rise in the first three months of the year.

The Federal Reserve has been counting on a slowdown in economic growth to keep inflation in check. Minutes of the Fed's August 8 meeting - when the Fed halted a two-year string of interest rate increases -- showed policy makers concerned about rising prices but patient on the need for more rate hikes as they awaited further economic data.

Tuesday, August 29, 2006

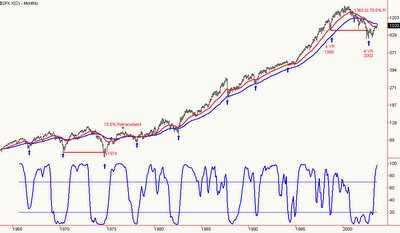

4 YEAR CYCLE LOWS

(click to enlarge, click bottom right corner *4 arrows to see orig)

http://www.walterbressert.com/PAGES/FREESTUFF/STOCKMARKET/092203/092203.htm

The 4-Year Cycle bottom that occurred in 2002 was the first 4-Year Cycle since 1974 to drop below a previous 4-Year Cycle bottom (as indicated by the horizontal red line), and our expectation is for at least a rise to the 50% retracement level at 1161, and quite possibly to the 78.6% retracement of 1365 as the current 4-Year Cycle tops, January through July, 2004.

**It is time to heed history. Market has made lows in OCT 9 of last 10 years. 4 yr cycle bottom is approaching. Congressional cycle (market does worse while in session, due back in Sept). Good news is out, Israel/Hessbolah war over. Oil is falling. Interest rates have declined.

Bear market which began in 2000 has not been satisfied. AT Oct 2002 lows the SPX was at 30X PE and yielded a scant 1.6% !!! (AVG PRIOR LOWS? 6% yields and single digit PE'S) WHere are we now? SPX X17 SPX yield near 2%.....more like a top than bottom. EVERY BEAR MKT has been satisfied as I described, this one will be no different.

What delayed the bottom? Near ZERO % interest rates, and a flood of liquidity. Tech bubble replaced by housing bubble.

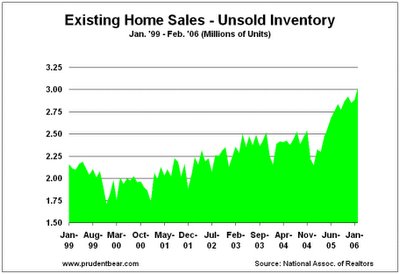

There is ample data as I discussed previous to believe the bubble has been pricked in housing, prices have JUST begun to decline. We read more of SOFT landing than those who believe something much worse is lurking. We have 4 decades high in housing inventory.

Slowdown in housing is going to trickle down to almost every aspect of our economy. It will be devestating. The mountain of debt that exists is historic. 30% of recent home loans were of dubious quality with schemes like "interest only" loans.

Market is making new highs with less and less stocks moving in strength, very FEW new highs. Market move is coming as result of less selling vs more buying. This IMHO is not sustaianable.

Inflation is above FED targets. Minutes from meeting due today. Could be market mover.

Consumer sentiment due at 10 AM, could be market mover.

Wed GDP data, could be market mover.

AVG retrace from from initial Bear MArket lows last avg of 3.5 years. That was in May, near the 2006 highs.

WHY are companies NOT investing in themselves with capital spending? ALL they are doing is M and A and buying back stock.

YOU will KNOW when a low is near, fear and blood will run in the streets, and you will be petrified to touch ANY stock with 10' pole.

Duratek

Monday, August 28, 2006

IF THIS ISN'T A BUBBLE THEN WHAT IS?

http://www.nytimes.com/2006/08/27/weekinreview/27leonhardt.html?_r=1&oref=slogin

Parabolic moves tend to be completely retraced. I wish but with record inventory to sell and sales plummeting, soft landing my ass.

Duratek

Saturday, August 26, 2006

SATURDAY MORNING POST " A PICTURE OF HEALTH?"

Recent reports show inventory of UNSOLD homes now stands at a historic record! After huffing and puffing this bubble, she has gone as far as she can go. Many speculators and new home buyers are STUCK in homes they have NO equity or aren't able to flip or sell. The result is signs like "RECENTLY REDUCED" or "NEW LOW PRICE" high inventory lack of demand will result in a housing price decline.

LOW interest rates alone are not enough to spur demand.

Shanghai real estate has risne 300% in last 3 years. The world is raising interest rates, trying to sop up excess liquidity or so it seems. As the FED has paused, that does not mean addt'l hikes are not possible. Falling long term rates do not give a picture of inflation nor of a healthy economy.

The market has been able to remain stable as there has been a respite in SUPPLY but demand has been flat, so we have gone nowhere.

Because the Dow consists of just 30 stocks, barely 2% of valuations, it can be manipulated. And the broader market has benefited from a strong performance of Bond funds and some foreign stocks. PEEL them away and you get a MUCH different picture.

If supply picks up with any force, the market will be set for a serious decline. We are nearing an end of seasonal strength. Sept/Oct is right around the corner.

Odd statistic, when Congress is in session, stocks do worse, is why when in recess, stocks get a summer rally some studies suggest.

And they are now do back, but recess again in OCT, could that be reason stocks usually bottom in October? 9 of last 10 years they have!

My eye is on the housing market, I see at this time NO other part of economy able to pick us up, if home prices continue to decline MANY will default, there has been recent weakness in the FInancial sector.

I remain vigilant until OCT has passed.

Duratek

Friday, August 25, 2006

"ROUBINI" ON HOUSING AND RECESSION

Aug 23, 2006

WASHINGTON (MarketWatch) -- The United States is headed for a recession that will be "much nastier, deeper and more protracted" than the 2001 recession, says Nouriel Roubini, president of Roubini Global Economics.

Writing on his blog Wednesday, Roubini repeated his call that the U.S. would be in recession in 2007, arguing that the collapse of housing would bring down the rest of the economy. Read more.

Roubini wrote after the National Association of Realtors reported Wednesday that sales of existing homes fell 4.1% in July, while inventories soared to a 13-year high and prices flattened out on a year-over-year basis. See full story.

'This is the biggest housing slump in the last four or five decades: every housing indicator is in free fall, including now housing prices.'

— Nouriel Roubini, Roubini Global Economics

"This is the biggest housing slump in the last four or five decades: every housing indicator is in free fall, including now housing prices," Roubini said. The decline in investment in the housing sector will exceed the drop in investment when the Nasdaq collapsed in 2000 and 2001, he said.

And the impact of the bursting of the bubble will affect every household in America, not just the few people who owned significant shares in technology companies during the dot-com boom, he said. Prices are falling even in the Midwest, which never experienced a bubble, "a scary signal" of how much pain the drop in household wealth could cause.

Roubini is a professor of economics at New York University and was a senior economist in the White House and the Treasury Department in the late 1990s. His firm focuses largely on global macroeconomics.

While many economists share Roubini's concerns about imbalances in the global economy and in the U.S. housing sector, he stands nearly alone in predicting a recession next year.

Fed watcher Tim Duy called Roubini the "the current archetypical Eeyore," responding to a comment Dallas Fed President Richard Fisher made last week in referring to economic pessimists as "Eeyores," after Winnie the Pooh's grumpy friend.

"By itself this slump is enough to trigger a U.S. recession: its effects on real residential investment, wealth and consumption, and employment will be more severe than the tech bust that triggered the 2001 recession," Roubini said.

Housing has accounted, directly and indirectly, for about 30% of employment growth during this expansion, including employment in retail and in manufacturing producing consumer goods, he said.

In the past year, consumers spent about $200 billion of the money they pulled out of their home equity, he estimated. Already, sales of consumer durables such as cars and furniture have weakened.

"As the housing sector slumps, the job and income and wage losses in housing will percolate throughout the economy," Roubini said.

Consumers also face high energy prices, higher interest rates, stagnant wages, negative savings and high debt levels, he noted.

"This is the tipping point for the U.S. consumer and the effects will be ugly," he said. "Expect the great recession of 2007 to be much nastier, deeper and more protracted than the 2001 recession."

He also sees many of the same warning signs in other economies, including some in Europe.

Rex Nutting is Washington bureau chief of MarketWatch.

Saturday, August 19, 2006

WHO'S YOUR DADDY?

D

Doug Noland A Must Read

Duratek

http://www.prudentbear.com/archive_comm_article.asp?category=Credit+Bubble+Bulletin&content_idx=57477

To get started, where’s the heightened risk aversion one would expect late in a tightening cycle? Where are the tightened “financial conditions” after 17 Fed rate increases? Where are the chastened borrowers, lenders, financiers, and speculators? Well, the leveraged speculating community flourishes and hasn’t missed a beat, and with this growth comes a thus far insatiable appetite for risky assets. Combining the powerful Wall Street firms, the global money center securities/insurance/”banks,” and thousands of hedge funds and you’ve got one almighty juggernaut “speculator community” that controls $10’s of Trillions of U.S. and global assets. To be sure, players today operate with an incentive structure unrecognizable to the traditional bank loan officer. Hedge funds typically take 20% of (realized and unrealized) fund gains at year-end, while Wall Street traders, investment bankers, derivative specialists and the like enjoy a share of booked profits with the arrival of their generous year-end bonuses. Such incentive structures nurture an all-consuming institutional inflationary bias.

It is, apparently, going to take a more intimidating housing slowdown to alarm speculators enticed by higher-yielding mortgage securities. The conspicuous excess that has of late beset corporate finance is anything but dissuading speculation in risky PIK (payment in kind) debt and other high-yielding corporate securities – especially not with the convenient embracement of “mark-to-model” pricing. And the incentive to write insurance (and immediately book much of the premium as “profit”) is simply too enticing to pass up, whether it is catastrophic weather reinsurance, Credit default derivatives, market hedges, or the myriad types of financial insurance/guarantees that have taken the U.S. and global Credit systems by storm. It is also clear that the perception of ongoing Federal Reserve accommodation has emerging market securities again in hot demand.

The current Financial Structure, dominated by Wall Street securitizations, leveraging, derivatives, and asset/securities speculation, inherently incites and then feeds runaway Credit, asset and speculative Bubbles. Under present conditions, the nature of this energized financing mechanism is not going to change, but rather only the sectors and asset classes where over-financing ensures spectacular boom and bust cycles.

“It appears that the current housing slowdown, which we first saw in September ‘05, is somewhat unique: It is the first downturn in forty years – in the forty years since we entered the business that was not precipitated by high interest rates, a weak economy, job losses or other macroeconomic factors. Instead, it seems to be the result of an oversupply of inventory and a decline in confidence. Speculative buyers who spurred demand in ‘04 and ‘05 are now sellers; builders who built speculative homes must now move their specs; and nervous buyers are canceling contracts for homes already under construction.” Robert Toll, Chairman & CEO Toll Brothers

In a predictable replay of the Technology Bubble, the U.S. homebuilding industry now faces the inevitable consequences from a period of spectacular over-finance and over-speculation (including massive industry overcapacity, collapsing profit margins and acute price uncertainty and instability). Industry executives have not previously experienced similar dynamics to this downturn specifically because there has never been a Financial Structure so capable of completely inundating the entire housing and mortgage arenas with cheap finance for such an extended period – never. As we witnessed with tech, destabilizing speculative flows appear seductively miraculous until they don’t.

Ultra-easy finance incited and then fed a speculative Bubble in home buying. At the same time, the nature of the Financial Structure saw to it that the homebuilders were also overwhelmed with finance, ensuring an enormous, destabilizing and self-reinforcing building boom. And the higher homebuilder stock prices ran and the cheaper their debt financings became, the greater the incentive to ignore the warning signs and race to develop more properties – to keep the dream alive and the liquidity spigot wide open. Moreover, the greater the boom the more the various segments of the ballooning U.S. Financial Sphere that wanted their piece of the action. And the resulting creative financing arrangements and instruments – and greater Credit Availability generally – the easier it became to finance ballooning transactions at higher prices (yet with lower individual mortgage payments!). Households inevitably succumbed to panic buying.

Many analysts these days hone in on the housing slowdown and the likelihood that the Fed has already raised rates too much to sustain the economic boom. My focus and concerns are instead directed at the precarious nature of a prevailing Financial Structure that ensures Serial Bubbles and Cumulative Economic Impairment and Financial Fragility. With acute vulnerability pervading some key housing markets - as well as the general risk to the Mortgage Finance Bubble - in the spotlight, the Fed is poised to accommodate the ongoing profligate financing environment. I find it astounding that our policymakers have absolutely no inclination – or demonstrate any sensitivity to their responsibility - to discipline or subdue “Wall Street finance.” Instead, they are determined to safeguard a highly improvident and destabilizing financial backdrop and incentive structure. This may very well perpetuate the current aged boom somewhat, but their will be no avoiding the painful aftermath. Today’s Menacing Financial Structure has decisively sealed such a fate.

DREAMING

I'M JUST A DREAMER WHO DREAMS OF BETTER DAYS"

IF ONLY WE COULD ALL FIND SERENITY

IT WOULD BE NICE IF WE COULD LIVE AS ONE

WHEN WILL ALL THIS HATE AND BIGOTRY BE GONE

I'M JUST A DREAMER SEARCHING FOR THE WAY, TODAY

I'M JUST A DREAMER DREAMING OF BETTER DAYS"

THANKS OZZIE

D

LISTENING IN WITH DURATEK

I believe in Trend Trading, yet I am not sure I can stomach STEEP draw downs to keep on trend.

I am in more agreement with you and KJ, that if they want to pay me 4% plus to sit there and do nothing so be it. I have 401K and get matching funds so that’s a cant lose deal, but you have sweet situation.

I cant seem to trust anyone with my money, so I continue the quest to get it right myself, sometimes the STRESS gets to me but I see no other way. I’m in TOO Deep, invested too much time and energy to leave a job yet unfinished.

I feel BEST method would be to avg that in each month into balanced portfolio, I would probably adapt the Brinker model, a proven winner in good markets.

But I don’t want to put my sidelined cash into this market, when we get to a identifiable bottom, then I will begin to slide it in. WONT do it at current levels.

ALL I know is what RR had pointed out, at OCT or March bottom 2002/2003 we had SPX at 30X and div yields ABOVE other known TOPS!! I see earnings rise and SPXPE come way down….but DIV yields show NO improvement.

We have one of longest periods of no 10% SPX correction, we have HISTORIC Dow Theory non confirmation.

I cannot believe the smartass FED and Bush skate free (though people suffer) with their plan to enrich those who don’t need it and enslave the others. And what PLAN that drives debt to historic levels ends well?

NAZ has had death cross of MA’S I follow, gold and energy seem to be correcting, so I cannot do much yet there, but I will.

Housing reports next week, I have been tempted to position in bond market, something holding me back, like safe MM yields, but they will begin to fall.

Master plan drove money out of MM’s in 2003 forcing investors to take on risk, it has worked well til now. Now MM’s fight for cash with market.

Recent rally has me on edge of my seat, scratching my head, but 9 of 10 years past mkt bottom IN OCT, so I cannot chase this move. I would however take some risks come selloff into OCT, bet your ass I will. And leave in DEC.

Income funds selloff into DEC so I would look there maybe.

Agree of course with being liquid, one reason Bonds not my bag.

I will check out your link today later, the same old game is played by yes these crooks…..fox in the henhouse again. Heck out situation on XNL, a BB stock (many have) found it easy to catch on AMEX, but seems something fishy going on there, many lemmings trapped.

Same old game… enjoy the conversation James

Friday, August 18, 2006

CONTRACTION

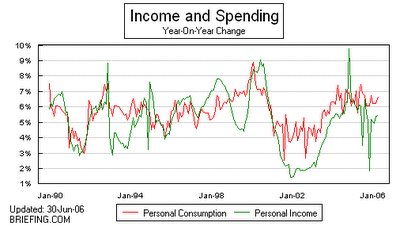

We are at ZERO growth here, nowhere close to even the slowing growth seen only partially here in 2005. Am I alone that find this troubling for the economy?

PS also steep DROP in Consumer Confidence this AM

D

PENSION REFORM

Today is options expiration day, 3rd Friday of every month. It could be a volatile day, but I am not expecting a big move either way. Consumer confidence numbers come out 10 AM

DELL numbers last night were horrid! 50% decline in earnings and income. Not sure in current environment if it will sink the NAZ today, might hold it down perhaps.

Commodities have been falling like a stone, like interest rates could be signalling an economic slowdown which at some point I believe will beome the MAIN focus of the stock market.

I missed the top in the 10 yr, as most of us have been focused by the FED and inflation near 5.25%, it is now about 4.87%

I see potential for rates to drop all the way back to 4.2% area, bottom of a channel I have drawn.....and I wonder if they will even challenge 5% again anytime soon.

I have been considering a few income stocks and funds for a part of my portfolio.

I am still expecting stocks to bottom in OCT timeframe, though recent runup has challenged my views, the recent Leading Inidcators have signalled trouble and I am steadfast that will become center stage when the NO MORE FED RAISE HYPE dies down.

I also get feeling most of easy money has been made on this move.

Duratek

Thursday, August 17, 2006

CSCO CHIEF SELLING ALL HE CAN

Hey, it's American to talk up your company forecasts as you are selling out the back door, say it aint so John I crown the' hypster king

D

"IS BUSH AN IDIOT"

hEY, I DONT MAKE IT UP, THIS FROM USUALLY PRAISING JOE SCARBOROUGH

d

Wednesday, August 16, 2006

RED TIDE

Dow has broken free of 11,250 zone ending today at 11,327. Isn't an ALL TIME high so close you can taste it? WOuld NAZ need to play catch up and really catch fire?

It doesn't pay to be STUBBORN when the market moves against your positions or beliefs. Housing bubble, falling prices, terrorism etc etc, high oil.....markets taken it all in and spit it back out.

Transports now need to play catch up, what then was their plummet from the 5,000 area all time high double top about? DO trasnports like falling oil? Does the markets?

Only the NAZ has given me a BEAR signal from my TA work. This signal has only been given 2 other times in last 6 years.

Market likes and believes FED is done raising interest rates, as they were in 2000 right before the top! but it likes it. It likes the manipulated PPI and CPI, says it doesnt have to worry about inflation.

Q's MAX PAIN # is $37. not sure how accurate it is, but that is where most pain would be felt by otpions buyers.....it makes sense mkt would gravitate near there, but it doesnt always.

SO we have weaker oil, truce in Middle East, same old shit in Iraq, falling long term interest rates, well THEY say it is because it isnt buying inflation story, but it could be saying economy is weaker than you think.

The nature of any retrace will tell us bundles.

Duratek

RANDOM THOUGHTS BEFORE AM DATA

NEW YORK (AP) -- Investors in Medifast Inc., which makes weight-loss products, on Tuesday will have to determine whether they think the company is shrewdly increasing dollars spent on advertising to grow sales, or is merely throwing money away. (PLUNGING by $5 !!!! who saw that coming??)

TUES data was a WEAK pHILA FED number, and a ZOOMING NEt Foreign PUrchases $75B !!!! WTF is saying foreignors are sick of our debt???

WASHINGTON (AP) -- Economists are predicting a 0.4 percent rise in consumer prices in July when the numbers are released this morning by the Labor Department.

Yesterday, it was announced that prices at the wholesale level edged up by the smallest amount in five months in July as falling food prices helped offset another rise in energy costs. (are you bleep bleep kidding me!??? there was a " seasonal adj to data !!!!!" this is pure BS!!! and what rally is based on, WHY I am not excited)

Consumer inflation slowed in June, helped by a temporary drop in energy prices. (again WTF???? WHAT DROP in energy pals what what???)The CPI rose by just 0.2 percent in June, the smallest increase in four months and just half of the 0.4 percent May rise.

contrast:

For July, energy prices were up 1.3 percent, the biggest increase since a 4 percent jump in April. Gasoline prices were up 0.7 percent, natural gas for home use was up 0.9 percent and residential electricity costs jumped 1.8 percent, the biggest increase since January.

Those higher energy costs were expected to show up quickly in higher consumer energy bills

***(I was getting my beloved some Kalamata Olives from Safeway last night, a meager looking fellow was counting loose change to pay for his $5 plus few items.....some reason had to be scanned again, maybe he gave something back he couldn't pay for. He quipped " Sorry about that, all this change, I paid my $2,800 mortgage !!!??? I'll be lucky to eat dogfood rest of month..." Checkout gal says "at least you paid it...." WOWEEEEEEE

Analysts are worried that rising inflation pressures may force the Fed off hold and result in further interest rate increases in coming months.

The 0.3 percent drop in food costs reflected a retreat in a variety of food costs which had surged in June. Egg prices fell by 26.1 percent, the biggest one-month drop in six years while fish prices were down 9.1 percent and soft drink prices dropped by 1.4 percent.

Outside of food and energy, prices were mostly lower with some notable exceptions. Tire prices jumped 3.5 percent, the biggest one-month gain in 27 years.

Offsetting that increase, the price of newspapers dropped by 1.2 percent, the biggest decline in 13 years, while the cost of light trucks was down 3.1 percent and the price of passenger cars fell by 0.8 percent.

http://biz.yahoo.com/ap/060810/analyst_note_ethanol_sector.html?.v=1 ethanol

Rousseau said VeraSun "is ahead of its peers in terms of capacity expansion plans." Aventine, meanwhile, is one of the lowest-cost producers of ethanol due to its particular milling technology and use of coal as a power source. The analyst called Pacific Ethanol's plan to build plants on the West Coast and ship corn from the Midwest "a unique but unproven business model."

Rousseau's outlook, however rosy, couldn't counteract the dampening effect of lower crude prices Thursday, and ethanol stocks moved lower in line with falling oil prices.

On Tuesday, VeraSun Energy shares got a boost after the company posted solid second-quarter profit, reversing a year-ago loss and coming in ahead of Wall Street's expectations.

Tuesday, August 15, 2006

MORNING DATA LEADS TO BULL SNORTING

Expected growth leaves lower annual growth of 4.4% yoy and 1.7% yoy for the core.

Annual growth peaked at a 15 year high of 6.9% (Sept 2005) and a decade high of 2.8% (July 2005) for the core.

Energy prices leave a 5th consecutive lift as seasonal adjustment lessens the July pain.

Pipeline pressure is rebuilding in core crude goods prices which reached a multi-decade high of 33% yoy in June.

Core intermediate goods prices at 7.3% yoy from a 23 year high of 8.5% in Jan 2005.

YES, futures are raging green, and an opening AM POP of 100 points or more looks likely and NAZ to 20 plus.....BUT this euphoria in this volatile and manipulated data is UNFOUNDED.

ENERGY prices remain at HIGHEST LEVELS of the year, I see NO refrain for consumer.

How did "they" do it? Energy prices leave a 5th consecutive lift as seasonal adjustment lessens the July pain. WHAT "seasonal adj"????

I am getting ACROSS THE BOARD 6% HIKES and more from ALL my suppliers, and this is AM passing on! Highest price hikes in 10 years!

I REMAIN cautious per seasonality as AUG nears a close, I CHOOSE not to jump on board, plus as GAP UP Likely, opening will hold near HOD. IMHO (a REVERSAL LIKE YESTERDAY WOULD DESTROY BULL CAUSE)

While they have you looking one way, here from CNN is reason for hooplah and 2 news blurbs you won't read:

Futures rally on inflation report Aug 15: 8:43a

Markets set for surge at open as tame report heightens hopes of further Fed pause.(here we freakin go again!) (more)

Wholesale inflation on the wane

Home Depot warns on full-year results and WALMART warns!!! (earnings have PEAKED IMHO)

AND MORE: (yhoo finance)

Analysts are worried that rising inflation pressures may force the Fed off hold and result in further interest rate increases in coming months.

The 0.3 percent drop in food costs reflected a retreat in a variety of food costs which had surged in June. Egg prices fell by 26.1 percent, the biggest one-month drop in six years while fish prices were down 9.1 percent and soft drink prices dropped by 1.4 percent.

Outside of food and energy, prices were mostly lower with some notable exceptions. Tire prices jumped 3.5 percent, the biggest one-month gain in 27 years.

Offsetting that increase, the price of newspapers dropped by 1.2 percent, the biggest decline in 13 years, while the cost of light trucks was down 3.1 percent and the price of passenger cars fell by 0.8 percent.

D

FIZZLE? AUGUST STEPHEN ROACH

As tempting as it is to extrapolate this into the future, that may be a serious mistake. There is a much better chance that global growth has peaked and the boom is about to fizzle.

The world’s main growth engine, the US, is slowing. That is the verdict from the labour market, with job growth in the past four months running 35 percent below average since early 2004. It is the verdict from the housing market, where an emerging downturn in residential construction activity is knocking at least 1 percentage point off the GDP growth trend of the past three years. And notwithstanding July’s temporary bounce-back in retail sales, it is a message from the consumer, whose inflation-adjusted spending growth fell to 2.5 percent in the spring period – one percentage point below the heady trend of the past decade.

America’s slowdown represents an important transition in the sources of economic growth, away from the vigorous wealth creation of asset bubbles – first equities, then housing – and back towards more subdued labour income generation. The delayed impact of higher interest rates is also taking a toll. Even though the Federal Reserve has put its two-year monetary tightening campaign on hold, there is a risk it has already gone too far. The confluence of higher energy prices, rising debt-servicing burdens, and negative personal saving rates reinforces the possibility of a pullback in discretionary US consumption and GDP growth.

This is an equally critical transition for the global economy. The world is about to lose significant support from the key driving force on the demand side of the equation – the American consumer. In a post-bubble climate, US households will be unable to save through asset appreciation, prompting America to increase income-based saving and reduce its claim on the pool of global saving. That points to a long-awaited reduction in the big US current account deficit – initially painful for export-dependent economies elsewhere in the world but ultimately a welcome resolution for global imbalances.

But who ill fill the void as the US consumer pulls back? The simple answer is; maybe no one. Europe, the world’s second largest consumer, is an unlikely candidate. Surprising economic growth on the Continent this year may be borrowing from gains that might have otherwise occurred in 2007. The European economy is about to be hit with a “triple whammy”: a big tightening in fiscal policy, the delayed impact of monetary tightening, and the drag of a stronger euro. Growth in the eurozone may exceed 2.5 percent this year, marking the strongest gain since 2000. Next year, it could slip back below 1.5 percent.

Do not count on a rejuvenated Japanese economy to fill the gap either. In dollar terms, Japanese personal consumption is only 30 percent of that in America; that means every 1 percentage point of slower consumption growth in the US would have to be replaced by about 3 percentage points of acceleration from Japan. As a weak second quarter GDP report indicates, such a surge is unlikely, especially as Japan copes with a stronger yen and higher energy prices. While growth in Japanese GDP should exceed 2.5 percent this year, in 2007 it could slow to less than 2 percent.

Nor are the two dynamos of developing Asia – China and India – likely to counter the slowing trend in the developed world. China has a seriously overheated economy. With real GDP surging at an 11.3 percent annual rate in the spring period and industrial output growing at a record 19.5 percent year on year in June, Beijing has little choice but to introduce tightening initiatives. A failure to do so could see trade protectionism squeezing exports and a deflationary overhang of excess capacity leading to an investment bust. China must shift its economy towards private consumption, a sector that sagged to just 38 percent of GDP in 2005. (A healthy rate would be at least 50 percent.)

All this points to a moderation of China’s growth beginning in 2007, with attendant reductions in its voracious appetite for commodities. That should spawn additional ripple effects in commodity producers such as Australia, Canada, Brazil and Africa. The world’s big oil producers would also feel repercussions from a Chinese slowdown. As would China’s Asian suppliers, such as Japan, Korea and Taiwan.

India is far too small to pick up the slack – less than half the size of China on a purchasing power parity basis. After more than 15 years of reforms, its growth has broken out to the upside – averaging 8 percent in fiscal years 2004-5. There was hope that a rebalancing from services to manufacturing would provide new impetus to growth, and the government seemed willing to tackle deficiencies of infrastructure, foreign direct investment, and saving. Unfortunately, the reformers have been stymied by the politics of coalition management. Imperatives of fiscal consolidation, with the delayed effects of recent monetary tightening, could also tip growth risks to the downside.

There is a deeper meaning to the coming slowdown. The global boom of the past four years was never sustainable. It was supported by the excesses of the liquidity cycle, which arose from emergency anti-deflationary actions of the world’s big central banks. The ensuing vigour of global growth was dominated by the US consumer, but America’s binge came at the cost of a record drawdown of domestic saving funded by the capital inflows of a record US current account deficit. The boom was balanced precariously on unprecedented global imbalances.

Excess liquidity bought time for a precarious world. As central banks move to normalise monetary policy, that time has run out. Without the unsustainable support of asset bubbles, it is back to basics – with aggregate demand supported by more modest labour income generation rather than the excesses of wealth creation. So much for the artificial boom of an unbalanced world. It could be about to fizzle out.

Note: This appeared as an editorial feature in the 14 August 2006 edition of the Financial Times.

Monday, August 14, 2006

Friday, August 11, 2006

Is the NAZ ready to rally?

http://stockcharts.com/h-sc/ui?s=$NDX&p=M&yr=10&mn=0&dy=0&id=p58304240138 (Then this monthly, look after over a decade of seperation, these Monthly MA'S have all converged JUST above current prices, and MACD is below zero for first time SINCE 2000!!)

Even my daily chart will show you what I see, and is a downtrend until it isnt, IMHO

http://stockcharts.com/h-sc/ui?s=$NDX&p=D&yr=0&mn=6&dy=0&id=p34930657201&a=82314172

D

Thursday, August 10, 2006

ANTI-TRUST CASE AGAINST INTEL and MORNING COMMENTARY

AMD suing over monopolistic practices at INTC, mainly in JAPAN.

The GENERALS, DELL; INTC;YHOO;EBAY;AMZN;GOOG;AMD; and a SLEW of others have been captured and hanged. You dont win military action without any generals, NAZ off 15% this year already.

General market leadership? Beaten down recent leaders.....CAT;MMM;DD;.......how many of the DOW 30 are near their 52 week highs?

Transports: Off nearly 20% from its "double top" all time highs. It is never good to have ONE INDEX going one way with the other/s going another way.

I believe the Transports are blowing a TUBA sized alarm, that ALL IS NOT WELL.

How is Housing doing? Largest UNSOLD inventory in at least 40 years? with prices still TOO HIGH?? DO you think weakness here will affect the employment scene? hasnt shown up yet has it?

Now the FED is pausing, watch LONGER term rates, will they defy logic and rise??????

Rest of world is TIGHTENING!!! OIL prices refuse to come down. Inflationary prices are now being PASSED ON and will filter into economy, FED sees this but can do nothing?

I am getting 6% price increases from most companies, got a 20% increase from one Canadian company.

REFI activity has EVAPORATED, this money WAS consumer spending backbone.

EMPLOYER employeee costs are RISING just as PRODUCTIVITY is FALLING!!!

I believe we have PASSED the PEAK in earnings........stock prices will fall IMHO.

Many indexes made their highs in typical fashion last MArch, it is my opinion and I am going to wait for a tradable bottom to appear in its traditional time frame SEPT/OCT and run with it thru DEC and cash out!

The FED pushed the envelope TOO HARD in housing to get us out of our deflationary bubble bursting spiral, but now it appears the HOUSING BUBBLE has been pierced.....and my friends, that can't be good.

Yesterdays reversal after a hoot n ninny open based on LOL CSCO!!!! WOOOOOOOOO was incinerated, cant be leaving bullsih traders with a warm fuzzy.

Duratek.....who you going to come to for the REAL STORY??

Wednesday, August 09, 2006

"OVERSUPPLY SLUMP WORST IN 40 YEARS!"

Builder: Oversupply slump worst in 40 years

Toll Brothers slashes outlook on new homes as orders plunge and revenue misses forecasts.

August 9 2006: 4:15 PM EDT

NEW YORK (CNNMoney.com) -- Homebuilder Toll Brothers said the current slump in residential construction is unlike any it has seen in 40 years as it became the latest to warn of a glut in new homes for sale and a slowdown in the closely watched real estate market.

The builder of luxury homes also reported weaker than expected preliminary results for the just completed quarter and cut its outlook for the homes it will sell in the current period. Toll Brothers (Charts) shares fell 4 percent in premarket trading.

The housing and homebuilding markets have helped drive the national economy during the past few years. Any downturns in these critical sectors could add to the problems of an already unsteady situation.

In a statement, company chairman Robert Toll warned there is a glut of supply of homes for sale in the market, as the building boom of recent years seems to be turning into a bust.

The slowdown "is the first downturn in the forty years since we entered the business that was not precipitated by high interest rates, a weak economy, job losses or other macroeconomic factors," Toll said in his statement.

"Instead, it seems to be the result of an oversupply of inventory and a decline in confidence," he added. "Speculative buyers who spurred demand in 2004 and 2005 are now sellers; builders that built speculative homes must now move their specs; and nervous buyers are canceling contracts for homes already under construction."

Markets where the company recorded big increases in cancellation rates included Orlando, Northern California, Palm Springs, Las Vegas and Phoenix.

The company's reported homebuilding revenues were approximately $1.53 billion in the quarter ending July 31, compared to the record of $1.54 billion a year earlier. Analysts surveyed by earnings tracker First Call had been forecasting a 7 percent increase in overall revenue at the company.

The Pennsylvania-based builder said it expects to deliver 2,500 to 2,800 homes in the current quarter, a cut of at least 14 percent from its previous guidance of 2,900 to 3,300. And the company announced signed contracts in the just completed quarter plunged 45 percent to $1.05 billion from a record of $1.92 billion a year earlier.

The company said it is not under as much pressure as many builders to cut prices because it builds relatively few homes on spec. But Toll said that much of the supply of finished and near-finished product is being marketed using advertised price reductions and increased sales incentives, which in turn is leading many potential buyers to delay their purchase decisions as they wonder about the direction of home prices.

But Toll said the company believes that, as there is a cutback in supply by builders, the housing market should be able get back on the growth track of recent years.

"With many potential buyers on the sidelines right now, we believe there is growing pent-up demand that will come into the market once buyer sentiment improves."

Toll said on a conference call Wednesday afternoon that he expects the slump to last at least through the end of the year, however, adding it could drag on for another two.

"But the market isn't dead," Toll said. "It's concerned with the direction of home prices and if it has reached the bottom. You might argue that this is the best time to buy a home, with comparatively low mortgage rates and incentives. It's very hard to pick a bottom and anyone who tries will probably have a problem."

Toll named some once previously hot markets as underperformers lately.

Florida has been fair or poor, for the most part, not an unexpected assessment during the summertime. Other down markets were Las Vegas and Reno, Chicago, Minnesota and the Maryland shore.

Stronger markets he named were Hoboken, Delaware, Colorado and Phoenix.

MARKET ACTION ALERT

Just made a new LOW for move and is RED for the day, non confirmations can be deadly,

D

Tuesday, August 08, 2006

HISTORY OF STOCK MARKET PERFORMANCE WHEN THE FED IS DONE?

**In my searching this is best info I could gather, and I bet it isnt what you expected.

Duratek

Subject: Re: stock market Answered By: wonko-ga on 27 Jun 2006 14:15 PDT

Despite experts recommending large cap stocks as good investments at

the end of a Fed rate tightening cycle, recent studies suggest that

both the S&P 500 and the Dow Jones Industrials have tended to trend

lower for the following 6 and 12 month periods. History does not

appear to support the popular thesis that the end of a tightening

cycle is uniformly good for stocks in general. However, financials,

health care, real estate, technology, and utilities have historically

performed well at the conclusion of a Fed rate tightening cycle.

Sincerely,

Wonko

Sources:

"Ironically enough, even in the unlikely event that the Fed is

finished raising rates, history has shown that alone is not enough to

boost stock prices. In fact, according to statistics gathered by Jason

Goepfert of SentimentTrader.com, since 1950, the average return in the

Dow Jones Industrials in the six months that follow the end of a rate

hike cycle is –2.7%. Basically, stocks generally move lower when the

Fed stops raising rates. Not the other way around. The idea that the

end of a rate hike cycle is bullish for stocks is not supported by the

market’s historical performance."

"INDEX INTELLIGENCE: Don’t Bet on the Fed" By Frederic Ruffy,

Optionetics.com (5/9/2006)

http://www.optionetics.com/articles/article_full.asp?idNo=14816

"But what the bulls see as an all-clear signal is far from a sure

thing. "There's quite a bit of talk about the market doing better once

the Fed (stops)," says Ed Clissold, senior global analyst at Ned Davis

Research (NDR). "However, more often than not the market has struggled

after the last rate hike."

Going back to 1929, the Standard & Poor's 500 was actually lower six

months after the last rate increase 71% of the time and down 64% of

the time 12 months later, according to data that NDR compiled for USA

TODAY."

"Odds are that stocks will drop once rate-rising stops" By Adam Shell,

USA TODAY (January 29, 2006)

http://www.usatoday.com/money/markets/us/2006-01-29-fed-stops-usat_x.htm

"Stock investors typically welcome the end of Fed tightening with open

arms, although the picture can be mixed for equities. The S&P 500 has

posted an average advance of about 8% in the year after the end of Fed

tightening, even as the economy loses serious momentum. This is

despite the fact that stocks have posted double-digit declines in two

of the cycles (after 2000 and 1981)—both times because the economy

slipped into outright recession. However, the good news is that

equities have normally posted even stronger gains (averaging almost

20%) in the second year after the Fed finishes tightening. The only

exception was the 2000 episode, when stocks were still melting from

extremely overvalued levels. Just as that cycle appears to be an

outlier, so too does the huge rally after the end of the 1995

tightening cycle, when stocks jumped 35% in the first year. Overall,

it seems that stocks are less beholden to the Fed rate cycle in recent

years (Chart 1)."

"When the Fed Stops" by Douglas Porter, Focus (June 9, 2006)

http://www.bmonesbittburns.com/economics/focus/20060609/

Experts are favoring large-cap stocks. Financial stocks are mentioned

by multiple experts, and five sectors have been shown to typically

perform better at the end of a rate tightening cycle.

"The financial sector historically benefits after the Fed stops raising rates."

"Capital Market Outlook" by Lynn Reaser, Harvey B. Hirschhorn, and

Joseph P. Quinlan, Banc of America Investment Advisers (June 12, 2006)

http://institutional.columbiamanagement.com/NR/rdonlyres/B1200E17-A2E0-4C93-B398-14DD747182BA/0/CMO_061206.pdf

"Q: How would an end to the Fed’s tightening cycle affect large-caps and the Fund?

A: First, we have to consider why the Fed would stop raising

interest rates. The consensus is that we’re going to see one or two

more Fed hikes in this cycle. However, we expect a very strong GDP

(gross domestic product) number for the first quarter of 2006, which

could persuade the Fed to continue to raise rates until they see some

compelling reason to stop. Reasons could include a major economic

slowdown, evidence that the inflation environment has become benign,

or a financial or geopolitical catastrophe like we’ve seen in the

past—though I’d put a low probability on the last example. Once they

feel enough inflation has been wrung out of the system and enough of a

slowdown has occurred, they may move to the sideline. Quality

large-cap growth names have historically done well in those

environments, and we believe we have built a portfolio that could

benefit in such a scenario.

Despite the slowing we are seeing, the U.S. consumer has remained

remarkably resilient. That has a lot to do with employment, which is

another important factor to consider. In our view, as long as

unemployment remains low, consumers are going to feel confident about

spending. Should there be a significant drop in the level of

employment, or should the consumer begin to really feel the effects of

higher energy costs and higher rates, that confidence and the

resulting economic activity could slow. Once again, in such an

environment, we would expect large-cap growth to outperform."

"Poised for a Rotation Back to Large-Cap Growth" A Conversation with

RCM’s Raphael Edelman, Allianz Global Investors (March 30, 2006)

http://www.allianzinvestors.com/commentary/mkt_insight_ts03302006.jsp

"Though were coming off of a low base in this example, stock markets

have still performed well in anticipation of the end of a

rate-tightening cycle, according to Sam Stovall, chief investment

strategist at Standard & Poor's. Stovall says that since the early

1970s, the S&P 500 advanced an average of 3% in the three-month period

preceding the last rate increase of a tightening period."

"Size may also play a role in stock selection during periods of rising

rates. "When interest rates move up, economic growth slows down," says

Rosanne Pane, mutual fund strategist at Standard & Poor's. "Investors

are attracted to companies with high-quality and consistent growth. We

believe this tends to favor the large-cap companies. On the other

hand, small-cap stocks, which usually exhibit higher growth rates,

tend to perform better when the economy is rebounding, as we saw in

2003."

Historical data show that after a period of credit-tightening ceases,

certain key sectors have performed very well over the next 12-month

period. For example, on Feb. 1, 1995, the Fed completed a year-long

tightening campaign that saw interest rates double, to 6.00% from

3.00%. For the one-year period ending Feb. 1, 1996, the average sector

fund in five key sectors -- financials, health care, real estate,

technology, and utilities -- delivered powerful gains."

"What Rising Rates Mean for Stocks" by Palash R. Ghosh, Business Week

(December 2, 2005) http://www.businessweek.com/investor/content/dec2005/pi2005121_5966_pi015.htm?campaign_id=search

Search terms: fed stock rate cycle sector large small cap; fed stock

rate cycle sector; fed stock rate cycle; History stock performance

Federal Reserve stops raising rates

A SOCIALISTS'S VIEW OF THE WTO TALKS BREAKDOWN

Does it makes for the US to subsidize ETHANOL by 50 cents a gallon while putting a huge TARRIF on any IMPORTS? The US taxpayers, you and me FOOT that subsidy bill!

WE could near import ALL our ETHANOL needs at a MUCH LOWER cost with this action.

D

Saturday, August 05, 2006

SEND A MESSAGE COME NOVEMBER!

(page 47 from book) Scowcroft, then Nat'l security advisor to 1st Bush. taken from interview in 2002 with Russert on Face The Nation

Scowcroft warned that A U.S. invasion of Iraq..."could turn the whole region into a cauldron, and thus destroy the war on terriorism." He went on to say in WSJ piece " If we reject a comprhensive perspective, however, we put at risk our campaign against terrorism as well as stability and security in a vital region of the world." (you are seeing proof of that now, Middle East violence,civil war in Iraq, protests in Iraq FOR Hezbola, against US)

How great is our Foreign Policy when we refuse to talk DIRECTLY to IRAN, N.Korea, etc etc.

WE can see "ticks on a dog" from our satelites in space, but all those shots shown to us supposedly PROOF we knew "exactly" where the WMD were, all turned out to be duds?

The American people sit quiet, while their rights are being stolen (Patriot Act) and while the Constitution is reinterpreted to fit the needs of our worst American President in history. And he isnt even that bright to begin with, he is a puppet.

Our policies are helping to build China as not only a world power in manufacturing, but as a world military super power. Their military buildup is in super nova high gear.

Friends? Russia and CHina both supply IRAN with military hardware.

Iran, Russia, Venezuala control world energy. And now CHina is on the move to secure its needs.

WE have NO energy policy. Bush is bought and paid for by the energy consortium.

Last 2 elections have been STOLEN from the people and the Democrats. Electronic voting machines can be easily tampered with.

I believe a LOUD and CLEAR drum will be beat come November, and even if you can't stand them, the Democratic candidates will win by landslides.....paving way for Democratic victory come 2008. I only pray it's not Hilary.

Other than Gore, I don't see now who else would be worthy of consideration, and am not sure he can win.

D

WILL THIS "PAUSE" REFRESH?

http://safehaven.com/article-5658.htm

IN A NUTSHELL WHAT IS BEFORE THE FED

August 4 - Financial Times (Chris Giles & Gerrit Wiesmann): "Interest rates rose across Europe on Thursday as the European Central Bank increased rates by an expected quarter point to 3 per cent, while the Bank of England surprised markets with an equivalent rise of its main interest rate to 4.75 per cent. The world's leading central bankers are now as one in tightening monetary policy. Thursday's European rate rises followed swiftly on the Bank of Japan's move to end its long-standing zero interest rate policy and the Federal Reserve's quarter-point rate rise to 5.25 per cent late last month. Australia this week also raised its key rate by 25 basis points to 6 per cent. Central bankers believe that four years of rapid global economic growth, high energy prices and historically low interest rates have led to mounting inflationary pressure worldwide."

WHO WILL PROTECT US?

Go directly to our issues page: http://www.truthout.org/issues.shtml

John Conyers The Constitution in Crisis http://www.truthout.org/docs_2006/080406R.shtml

Congressman John Conyers released the final version of his report today, the "Constitution in Crisis." The report, which is some 350 pages in length and is supported by more than 1,400 footnotes, compiles the accumulated evidence that the Bush administration has thumbed its nose at our nation's laws, and the Constitution itself.

Thursday, August 03, 2006

THE LANDING PAD

I have done my research, and the market consistantly bottoms in OCT, 2003 it was AUG because of end of bear. AUG-OCT historically have been the WORST times to be IN the market.

LOTS of EMPHASIS is being placed on FRI employment report (a STRONG report will roil markets IMHO) as being THE data point the FED will make their decision on rates next week.

MANY are calling for the end of rate hikes then, and that it will PROPEL mkt into stratosphere.

I think we go sideways until that day 2:15 you know what they know. The report tomorrow could set the tone, tune in 8:30 AM briefing.com

D

GOING NOWHERE SLOW

Generals raise fears of Iraq civil war AP - 1 hour, 49 minutes ago

WASHINGTON - The top U.S. military commander in the Middle East told Congress on Thursday that " Iraq could move toward civil war" if the raging sectarian violence in Baghdad is not stopped. "I believe that the sectarian violence is probably as bad as I have seen it," Gen. John Abizaid, the commander of U.S. Central Command, told the Senate Armed Services Committee.

**NOT enought boots on the ground, Iraqi's not ready to take over for US Troops, didn't start with a sound plan and we have made an unstable region more so, not what was intended in the "Master Plan".

Nope, it was WORLD PEACE, place another Democracy in Middle East and watch it spread (but terrorism spread), watch OIL prices decline as US gains control of 2nd richest KNOWN reserves and pumps like mad (OIL has TRIPLED!)

Best laid plans go astray, bad plans go bust!

D

Tuesday, August 01, 2006

REASONS TO IMPEACH?

Is there a Congressman in office that is awake?

Read FIASCO, pretty scarey if someone like WOlfowitz could influence a President to go to war.

D