(click to enlarge, click bottom right corner *4 arrows to see orig)

http://www.walterbressert.com/PAGES/FREESTUFF/STOCKMARKET/092203/092203.htm

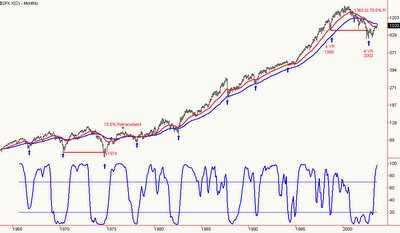

The 4-Year Cycle bottom that occurred in 2002 was the first 4-Year Cycle since 1974 to drop below a previous 4-Year Cycle bottom (as indicated by the horizontal red line), and our expectation is for at least a rise to the 50% retracement level at 1161, and quite possibly to the 78.6% retracement of 1365 as the current 4-Year Cycle tops, January through July, 2004.

**It is time to heed history. Market has made lows in OCT 9 of last 10 years. 4 yr cycle bottom is approaching. Congressional cycle (market does worse while in session, due back in Sept). Good news is out, Israel/Hessbolah war over. Oil is falling. Interest rates have declined.

Bear market which began in 2000 has not been satisfied. AT Oct 2002 lows the SPX was at 30X PE and yielded a scant 1.6% !!! (AVG PRIOR LOWS? 6% yields and single digit PE'S) WHere are we now? SPX X17 SPX yield near 2%.....more like a top than bottom. EVERY BEAR MKT has been satisfied as I described, this one will be no different.

What delayed the bottom? Near ZERO % interest rates, and a flood of liquidity. Tech bubble replaced by housing bubble.

There is ample data as I discussed previous to believe the bubble has been pricked in housing, prices have JUST begun to decline. We read more of SOFT landing than those who believe something much worse is lurking. We have 4 decades high in housing inventory.

Slowdown in housing is going to trickle down to almost every aspect of our economy. It will be devestating. The mountain of debt that exists is historic. 30% of recent home loans were of dubious quality with schemes like "interest only" loans.

Market is making new highs with less and less stocks moving in strength, very FEW new highs. Market move is coming as result of less selling vs more buying. This IMHO is not sustaianable.

Inflation is above FED targets. Minutes from meeting due today. Could be market mover.

Consumer sentiment due at 10 AM, could be market mover.

Wed GDP data, could be market mover.

AVG retrace from from initial Bear MArket lows last avg of 3.5 years. That was in May, near the 2006 highs.

WHY are companies NOT investing in themselves with capital spending? ALL they are doing is M and A and buying back stock.

YOU will KNOW when a low is near, fear and blood will run in the streets, and you will be petrified to touch ANY stock with 10' pole.

Duratek

No comments:

Post a Comment