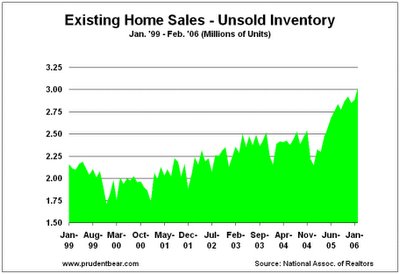

Recent reports show inventory of UNSOLD homes now stands at a historic record! After huffing and puffing this bubble, she has gone as far as she can go. Many speculators and new home buyers are STUCK in homes they have NO equity or aren't able to flip or sell. The result is signs like "RECENTLY REDUCED" or "NEW LOW PRICE" high inventory lack of demand will result in a housing price decline.

LOW interest rates alone are not enough to spur demand.

Shanghai real estate has risne 300% in last 3 years. The world is raising interest rates, trying to sop up excess liquidity or so it seems. As the FED has paused, that does not mean addt'l hikes are not possible. Falling long term rates do not give a picture of inflation nor of a healthy economy.

The market has been able to remain stable as there has been a respite in SUPPLY but demand has been flat, so we have gone nowhere.

Because the Dow consists of just 30 stocks, barely 2% of valuations, it can be manipulated. And the broader market has benefited from a strong performance of Bond funds and some foreign stocks. PEEL them away and you get a MUCH different picture.

If supply picks up with any force, the market will be set for a serious decline. We are nearing an end of seasonal strength. Sept/Oct is right around the corner.

Odd statistic, when Congress is in session, stocks do worse, is why when in recess, stocks get a summer rally some studies suggest.

And they are now do back, but recess again in OCT, could that be reason stocks usually bottom in October? 9 of last 10 years they have!

My eye is on the housing market, I see at this time NO other part of economy able to pick us up, if home prices continue to decline MANY will default, there has been recent weakness in the FInancial sector.

I remain vigilant until OCT has passed.

Duratek

No comments:

Post a Comment