Wednesday, August 31, 2005

G-D Speed to KAtrina Victims

Duratek

HEDGE FUND GHOULS

Post-hurricane, crude oil prices shot up about $3 a barrel – or $3,000 per futures contract. While the NYMEX exchange limits funds to 20,000 contracts, most funds hold between 5,000 to 10,000, according to traders. A fund with 10,000 contracts would have netted a cool $15 million from the $3 spike.

BUT These same bleeps were doing this!

NEW YORK (CNN/Money) - For some hedge funds, getting involved in the reinsurance business looked like a good idea last year, when some high-profile shops set up reinsurance operations. Then came the $16 billion hurricane.

Cash-rich and hungry for untapped investment opportunities, a handful of hedge funds set up or invested in firms that specialize in reinsurance, which is coverage that insurance companies buy to pass on some of their risk to a third party – essentially, an insurance policy for an insurance policy. When insurance companies get hit up by their policyholders, the insurance companies in turn hit up the reinsurers.

LOOKING Like 2000- 2002??

Highlights from briefing.com

An unbelievable plunge to 49.2 in August Chicago PMI index (-14.3 pts).

Key Factors

Record sized plunge leaves index in a contractionary sub 50 level -- the first since April '03 after reaching a 17 yr high in March.

New orders (30% weight) plunged an astounding 23 points to 46.5 -- presumably off the highs in oil prices.

Production fell to 56.2 from a nose bleed 70.5 in July as it followed orders.

Employment fell in line to 51.7, March stood at a high 66.

Prices paid rose to just 62.9 and doesn't reflect the pricing fear we are assuming caused the orders plunge.

Big Picture

There really is no clear explanation for the 14.3 pt August plunge to a negative 49.2 read in August. Oil price concerns are very real but even the prices paid index rose only modestly to 62.9. Prior to August strong gains continued to lift the index to a 17 year high of 69.2 in March before falling off sharply and rebounding in July. The strength of business investment which had turned up the heat (furnaces) in manufacturing softened with the end of capital investment tax incentives as inventories have been drawn down to satisfy near term demand. The manufacturing sector moves in sharper cycles than the overall economy and the regional measures move in even shorter, more volatile patterns. Strong business investment demand will rebound given large positive cash flow, profits, low financing rates and strong business activity.

As the Worm Turns

We have end of month marking up going on, and maybe it seems to obvious that high oil and 1 million displaced Americans was not bullish for economy, so players went against the grain and it worked well today.

Maybe markets will hold up into mid Sept, but I wouldn't bet on it.

So far, just a trading range market, going nowhere. And the effects of Katrina for now being discounted in some quirkish obscene bullish way.

D

OIL TO FALL?

August 31, 2005

Sydney - The price of oil is likely to fall to $40-$50 per barrel in the next 12 months, BHP Billiton chief executive Chip Goodyear predicted on Wednesday.

The head of the Anglo-Australian resources giant said the crude price, which was approaching $71 on Wednesday in the wake of Hurricane Katrina's devastation of the US Gulf Coast, would fall over a 12-month time span as supply increased.

"In a year, I think you're probably looking at a range of probably the 40-50 US dollar mark," Goodyear told the Forbes Global chief executive officer Conference in Sydney.

Goodyear said there would be upward pressure on oil prices over the long-term due to increased demand from developing countries.

"Long term, I think we're all aware that there are billions of people out there in the world that have something that we are used to, which is the automobile, that they aspire to," he said.

"That's going to increase the amount of demand for petroleum products."

Conference organiser, billionaire business publisher Steve Forbes, predicted on Tuesday that oil prices would crash from this week's record highs as a speculative market bubble bursts.

Forbes said oil would fall to $30-$35 a barrel within a year. - AFP

MANDRAKE MECHANISM

MUST READ REPOST FED RESERVE UNMASKED!

FUEL CELL HYDROGEN HYPE???

LINK CLICK HERE Read carefully, it puts forth a powerful article on why, though 100% CLEAN, it is NOT efficient.

SO, IMHO MOST of these companies will fail, stocks may rise, but it won't be from profits IMHO and MOST will run out of cash, is there enough HYPE from soaring oil to run these stocks up for a trade?

SAD THING? IF BUSH hadn't veto'd the gasoline auto efficiency mileage bill mandating better avg per miles to fleet we might not be having this CRISIS!!!! OIL has BUSH in their pocket!

NEW energy bill? $$$$$$ for pig rich energy companies, NONE for consumers, not a word on getting better mileage!

D

HYDROGEN HIGHWAY or FAIRYTALE?

HYGS bought Stuart Energy last year (HHO.TO) , the company which was the leader in refueling station technology. I think this is the smartest play in Hydrogen hype, it rose to near $4 yesterday on STRONG VOLUME, as did many.(it's trend has been to rise and give back its gains) CPST as I posted, has gotten ahead of itself and it is hard to tell if a company is overvalued? CPST said to be running out of money very quickly, yet shares changed hands over 10X daily volume Tues. a mania? As was NANO particals? which have fallen "quiet" lately....some are NGEN NANO and NANX if you want to follow them.

FUEL CELL NEWS great site!

FUTURE OF FUEL CELLS

BERKELEY, Calif. (Reuters) - Automakers outlined plans on Tuesday to introduce hydrogen-powered cars in California but said they had a long road ahead, despite strong support from Gov. Arnold Schwarzenegger who dreams of a "hydrogen highway."

General Motors Corp, Japan's Honda Motor and Germany's BMW are pursuing competing technologies to introduce new "zero emission" cars that run on fuel cells and do not pollute, said engineering and marketing managers for the three automakers.

BMW, however, may have a leg up to market a new car in California and Europe powered by a gasoline engine and a hydrogen fuel cell system. The German automaker plans to offer a limited number of the new 7-series model in 2010, Wilhelm Hall, general manager of environmental engineering at BMW North America.

He spoke at a briefing for reporters on California's efforts to persuade automakers to manufacture more environmentally friendly cars for California's "hydrogen highway."

BMW plans a production run of the new car "in the hundreds" in five years with sales aimed at fleet operators and individuals in Europe and the U.S., Hall told Reuters.

California drivers, battered by soaring prices at the gas pump, are snapping up new cars like Toyota's gasoline-electric Prius hybrid which combines smart looks and high miles-per-gallon.

Prius vs. Hummer

Hollywood celebrities have adopted the quiet Prius as a kind of environmental badge of honor, while plenty of gas-guzzling Hummers continue to roar over the state's freeways where they are the object of envy and scorn.

California, which has paced the U.S. in implementing regulations to reduce greenhouse gas emissions linked to global warming, aims to promote the use of hydrogen fuel to reduce its dependence on oil while improving the environment.

The state's "hydrogen blueprint," one of Schwarzenegger's favorite programs, calls for up to 2,000 hydrogen vehicles and 100 refueling stations by 2010 at an estimated cost of $54 million.

The fuel outlets would be concentrated in San Diego, Los Angeles, the San Francisco Bay area and Sacramento.

Depending on the results of the first phase, California would aim for 20,000 hydrogen vehicles and 250 fuel stations.

GM is developing a demonstration car called the Sequel powered by a compressed hydrogen engine, said Al Weverstad, executive director of

GM's Public Policy Center.

Weverstad said GM will complete its engineering analysis on hydrogen vehicles by 2010, but no timetable has been set for production and marketing programs. GM is concerned about development costs, he said, but added: "We are confident we will get there."

Honda has developed a hydrogen fuel cell demonstration car and also a car running on compressed natural gas that can be refueled at home.

Steve Ellis, manager of fuel cell marketing for Honda in California, said the company's strategy for lower-emission cars moves from high gasoline fuel economy to gasoline-electric hybrids to compressed gas to hydrogen fuel cell models.

Tuesday, August 30, 2005

CAPSTONE ACTION

Did you see the miles and miles upon miles of land under water? And it hit the poorest worst. A whole city out of action plus Mobile and others for months and months.

High oil is causing a stampede to alternative enrgy plays, but like above article, these companies will run out of cash before ever sniffing a profit, be careful here.These little gems could become very volatile.

2 better companies IMHO are HYGS and QTWW, more going for them in long run. I do not own shares at this time. HYGS has good resistance near $4, PBW is a clean energy fund, more diversified if interested.

A lot of bad things swirling around IMHO, and it isn't like consumers are already sitting in catbird seat either.

Long time bulls have not changed their stance on iota. $65 oil no alarms, but $70 yes?????

Energy play couldn't be more exposed and loved.

Future growth and SPX profit growth at risk.

In Sept, volume should increase, rubber will meet the road and it may burn.

Are you just sitting there fully invested in stocks? Maybe good time to talk to a pro and make sure you are diversified in a way that makes you comfortable, IMHO over exposure to stocks could be short to intermediate term painful.

And your goals might be different if you are closer to retirement than if your time horizon is much farther out. I would RAISE CASH levels to at least 25% maybe 40% so if a decline of measurable intensity arrives, you will have CASH to buy at much lower levels, if FULLY invested you can't do that....and I find little to convince me broad economic expansion is around the corner.

Duratek

BONDS

click for larger image

If bonds at a low, they need to RISE immediately (in yield).Near .618 FIB

Similar TA at previous lows.

D

Inversison dead ahead

click for larger image.

Greenspan has 2 lips, one for manipulating rates lower long term, and one to warn of housing bubble.

Duratek

GUITAR LOVERS!!!!

Then see his TOUR DATES, BEST live performance, jam band incredable band

D

ROCK AND HARD PLACE

The market was also jolted by minutes of the rate-setting meeting of the Federal Reserve on Aug. 9, which showed most participants viewed U.S. inflation as having accelerated and high energy prices as a "significant drag" on the economy.

AND THIS

Energy Prices, Jobs Climate Underscore Policy-Makers' Need for Rate Hike, Fed Minutes Show

WASHINGTON (AP) -- Surging energy prices and a strengthening jobs climate raised the risk that inflation could worsen, underscoring the need for Federal Reserve policy-makers in August to keep boosting short-term interest rates higher.

**Some last minute tinkering saved todays market, don't be fooled it is safe. Perfect STorm is here. INVERSION of yield curve is next

D

Market got you down?????

Let Jolie make it all better for you.....or you could just read my damn blog!! LOL

But I DO have my finger on the pulse do I not?

D

A Friendly Reminder

As I stated below, I SHARE my opinion, my purpose is to open your eyes to what may be actually going on. YOU must decide what to do or not to do or seek the advice of a pro.

This is one of the reasons I have hesitated giving any info of direct actions I may take in market, as I charge nothing for my opinions, as I want it.

My main theme is one of CAUTION, so its not always about how much you can make but how much you manage NOT to lose!

D

HOUSING BUBBLE?

The "housing bubble" is due to burstConsumers are selling their homes in hopes of taking advantage of the "housing bubble" before it bursts.

Overview:

My wife and I have lived in the same home for 25 years, raised both of our children there, and owned the property outright without any loans or mortgage.

I don't say that for sympathy, but to illustrate that we played by the rules, worked hard, paid our taxes, and took advantage of the American dream of home ownership.

The current housing bubble is "larger than the global stock market bubble in the late 1990s (an increase over five years of 80% of GDP) or America's stock market bubble in the late 1920s (55% of GDP).

The banks have lowered the standards for home loans to such an extent that the traditional loan of 20% down and a fixed interest rate is virtually a thing of the past.

Consider this: In 2004 "one-fourth of all home-buyers -- including 42% of first-time buyers -- made no down payment."

Sorry, but if a buyer can't come up with at least $5,000 dollars for a down payment, he shouldn't qualify for a home loan.

Equally troubling is the fact that "nearly one third of all new mortgages this year call for interest-only payments (in California, it's almost half)" (NY Times) This tells us that a large number of new buyers can barely make their payments, but are gambling that their property value will go up enough to justify their investment.

Remember, "class-warrior" Alan Greenspan lowered the prime rate to a ridiculously low 1% in 2002 to keep the economy humming along while $300 billion was sluiced into Bush's "preemptive" war in Iraq and while the tax cuts were siphoning the last borrowed farthing out of the public coffers.

The Bush tax cuts transferred an average of $400 billion dollars per year into the pockets of America's plutocrats.

Source: http://www.dissidentvoice.org/July05/Whitney0727.htm

NewsTarget.com printable articleMonday, August 29, 2005

The "housing bubble" is due to burstConsumers are selling their homes in hopes of taking advantage of the "housing bubble" before it bursts.

Overview:

My wife and I have lived in the same home for 25 years, raised both of our children there, and owned the property outright without any loans or mortgage.

I don't say that for sympathy, but to illustrate that we played by the rules, worked hard, paid our taxes, and took advantage of the American dream of home ownership.

The current housing bubble is "larger than the global stock market bubble in the late 1990s (an increase over five years of 80% of GDP) or America's stock market bubble in the late 1920s (55% of GDP).

The banks have lowered the standards for home loans to such an extent that the traditional loan of 20% down and a fixed interest rate is virtually a thing of the past.

Consider this: In 2004 "one-fourth of all home-buyers -- including 42% of first-time buyers -- made no down payment."

Sorry, but if a buyer can't come up with at least $5,000 dollars for a down payment, he shouldn't qualify for a home loan.

Equally troubling is the fact that "nearly one third of all new mortgages this year call for interest-only payments (in California, it's almost half)" (NY Times) This tells us that a large number of new buyers can barely make their payments, but are gambling that their property value will go up enough to justify their investment.

Remember, "class-warrior" Alan Greenspan lowered the prime rate to a ridiculously low 1% in 2002 to keep the economy humming along while $300 billion was sluiced into Bush's "preemptive" war in Iraq and while the tax cuts were siphoning the last borrowed farthing out of the public coffers.

The Bush tax cuts transferred an average of $400 billion dollars per year into the pockets of America's plutocrats.

Source: http://www.dissidentvoice.org/July05/Whitney0727.htm

All content posted on this site is commentary or opinion and is protected under Free Speech. Truth Publishing LLC takes sole responsibility for all content. Truth Publishing sells no hard products and earns no money from the recommendation of products. Newstarget.com is presented for educational and commentary purposes only and should not be construed as professional advice from any licensed practitioner. It is not intended as a substitute for the diagnosis, treatment or advice of a qualified professional. Truth Publishing assumes no responsibility for the use or misuse of this material.

CHAIN SMOKING

It's ALL about the oil? Look for headlines in CNN or YHOO financial page for what isn't the causal factor of the day. They NEVER called me and asked for my quote!

Factory orders DECLINE AM DATA, Consumer Confidence slips. We are in that small window, end of month and first few days of month wise guy mark ups with positive bias, see what hay the market can make.

IF 2006 economy is going to be a dissapointment, the markets will see this some time in advance, be nimble, VERY nimble if long.

It's so much not about Katrina or quote of the day, it is about the ground under our feeet as I continuosly try to lay out the reasons for AVIAN FLU ECONOMY.

We have our booms, then busts, and the bottoms always look similar, only the past Bear bottom looked more like a top! The PAIN only delayed, many have used this opp to exit with their shirt.While the unawares lemmings stride closer and closer to the edge, when ONE of them jumps, you will see it in the VIX! This unusual period of LOW LOW COMPLACENCY is coming to an end.

GOLD PLUMMETS this AM off $5, where is the metals indication of inflation? TOO MANY dollars chasing TOO FEW goods? How about Too FEW dollars chasing TOO MANY goods, because inflation of the things we must have has ROBBED precious consumer spending dollars and taken US Savings rate down to Depression like ZERO!

LONG ago the US lost control of its destiny.......as 2 faced Greenspan is in complete denial of his role............and he continues to squeal a warning.

ANY inability of markets to rally and or volume to pick up on said during this PEAK bullish zone, will NOT speak good for the period directly after!

I laid out the history going back to 2003 in an earlier post

Duratek

Monday, August 29, 2005

INVESTORS NOT INTERESTED?

RR thinks investors have turned away from stocks to real estate.

Then WHY is share volume at record levels even as Dollar volume is 25% of what it was?

Thanks to cross-currents.net

D

DOH! I should have invested in lumber!

"need some wood?"

And Kerry turned into the dead wood for the dem's hopeful. Bush lame, democratic party? very lame!

SCRIPT WRITERS DILEMA

CNN

5:43p

Downgrade of Hurricane Katrina, retreat for oil prices, help stock market recover, rise.

*They must have a NEW tagline for each days action, no matter how stupid. When storm "ebbed" it left multi billions of destruction! how wonderful!

Those who missed out on the first real estate bubble get a second chance......

D

FLECK ON HOUSING

D

SOME DOW TA Observations

Short pause in early Sept, then full speed to yr end.

FEB was high in ’04 and ’05 !! Stocks now lower than in FEB ‘04

Steep decline began in EARLY Sept ’04 bottomed in MID OCT set up rally to DEC but declined into mid JAN then set up Jan/FEB ’05 high with sharp rally.

Right shoulder off 10,940 high now in place in area of 10,651, left shoulder way back in ’04 at 10,627 Feb

Conclusion 10,940 key to Bullish case (maybe even 10,627-51) or bearish case if holds.

Bearish case break of 10K

SToch weekly declining along with WEAK MACD support bearish SEPT IMHO

WE might first now get some points into VERY early Sept, then seasonal weakness takes over.

LONG BOND CONUNDRUM

Low Bond Rates Mean Ever Higher Funds Rate

August 04, 2005

An important, but largely overlooked article by Greg Ip in yesterday’s Wall Street Journal clearly signals the Fed’s intentions to keep raising the fed funds rate until the long-rate increases sharply as well. In our view this can have only negative consequences for both the stock market and the economy.

Greg Ip is known to be a conduit through whom the Fed communicates with the public, and he states at the beginning of the article that “officials there increasingly believe…”. It is obvious from the tone that the reporter was given an off-the-record interview with one or more Fed officials, most likely including Greenspan himself. This would be in keeping with prior periods when it was well known that the Fed used the Journal, the New York Times and John Berry, formerly of the Washington Post, to disseminate views that they did not want to state for attribution.

The article states that the bond market in keeping long rates low was diluting Fed “efforts to tighten credit and contain inflation. The result: The longer the bond market keeps long-term rates unusually low, the further the Fed is likely to raise the short term rates…” According to former Fed governor Laurence Meyer, low bond yields “are telling the Fed its job isn’t done and they have to keep going.”

It is clear from prior statements, however, that it's not economic overheating and inflation that the Fed is worried about—it is housing prices. Over the past few months words and actions by the Fed and other financial institutions strongly indicate they are more worried than they say about the bubbling housing market, and the low yield on the long-term bond is a primary culprit. In mid-May the Fed and a number of other agencies, in a try at moral suasion, issued new guidance to mortgage lenders in an attempt to dampen a number of speculative practices that were contributing to the bubble.

In addition Greenspan’s congressional testimony and speeches by other Fed governors have devoted an increasing portion of space to the “froth” in local markets. They obviously must be aware that these “local” markets include the Northeast seaboard, Florida, and California as well as many other points inland as our emails will attest. These areas comprise a huge portion of the U.S. population and total national home values. It is also these same areas that have provided the mortgage refinancing cash-outs amounting to hundreds of billions of dollars that have helped keep consumer spending afloat and the savings rate close to zero. In Greenspan’s congressional testimony on July 21 he directly attributed the boom in home prices and associated risks to the unusual drop in long-rates in the face of an increase in the fed funds rate.

In our view the Fed is walking a fine line. They recognize that they must do something about the bubbling housing market, yet run the risk of going too far and throwing the economy into recession and the stock market into a deep downtrend. Since the start of the Fed in 1913 they have instituted a policy of monetary restraint 15 times prior to this one, and in the vast majority of cases, stocks have declined significantly and the economy has gone into recession. With the current economic expansion so unbalanced, growth so dependent on housing, and consumer debt at record levels, the chances of the economy getting out of this mess unscathed look exceedingly small—and this is without even considering the high level of oil prices and the record trade imbalance.

**Also from FRI and SAT Greenspan comments, this appears to be true.

D

DR DOOM short take

August 25, 2005

The Credit Supply Is About To Begin a Major Deflation

The June 28 issue of "Bullion Buzz" quotes investment guru Jim Rogers as saying, "Anyone who thinks there will be deflation does not understand twenty-first century banking. There may well be a deflationary collapse later, but before that happens the government will print money until the world runs out of trees." Of course, Jim is a legendary market analyst, but it is rare to hear him take a stand against the minority view. In this case, his words can pertain to only about half a dozen people in the United States, with the other 299,999,994 of them siding with Jim. They are, moreover, putting their money where their mouths are, buying stocks, commodities, gold and property and borrowing money at an unprecedented rate on the conviction that it will consistently lose value. Usually the crowd is wrong, and this is a big crowd.

At this point, dollar-denominated debt has reached $37.3 trillion. The economy has little basis on which this ocean of debt will be repaid. With investment markets poised to fall across the board, the United States, and probably most of the world, is on the cusp of a great deflation. The credit supply will contract, and despite ubiquitous professional and popular belief to the contrary, there is nothing that the Fed can do about it. (See Chapters 11 and 13 in Conquer the Crash.) By the time the central bank gets around to printing money as opposed to offering credit, the devastation will have run its course.

The Economy Is About To Resume Its Trend Toward Depression

The economy started a depression in 2001, and it’s not over. The recovery of 2002-2005 is akin to those in the Japanese economy since it topped out in 1989. It is not a new trend of expansion but simply a respite. When the Dow breaks 8000 and silver falls below $6.00, we should begin to see hard numbers indicating renewed economic contraction.

Safe Havens Remain the Only Sensible Choice

Cash will buy a whole lot more a few years from now than it does today. You can already buy a share of the S&P 500 for 20 percent less than in 2000 and a share of the NASDAQ for 60 percent less. You can buy a car for 20 percent less than a few years ago. When oil and real estate turn down, we will begin to see lower prices on virtually all goods and services.

This article is an excerpt from The Elliott Wave Theorist and/or The Elliott Wave Financial Forecast monthly newsletters. Get the very latest analysis from Robert Prechter’s Elliott Wave International. www.elliottwave.com/a.asp?url=http://www.elliottwave.com&cn=ir

To get Robert Prechter’s complete forecast for a deflationary depression, plus practical advice on how to survive and prosper during this period, read Conquer the Crash. The first edition achieved #1 status on the New York Times and Wall Street Journal bestseller lists. The expanded and updated edition for 2004 is now available. Order your copy now. www.elliottwave.com/a.asp?url=conquer&cn=ir

AHH KATRINA!

NO VOLUME! Some indicators pointing to rebound of some kind. Monday typically good day for wise guys to push it up, is it only Hedge Funds left to trade the market?

BUT 53 new LOWS today . Most new lows this year? ABove 40 bad sign is continues.

I fell this is counter move to larger down trend, we coming into notorious bad seasonals. Marking them up before they mark them down, IMHO.

IF OIL begins to decline in earnest, could fuel rally, but IF OIL falls, most likely from declining demand! Is why RISING oil in a bull market is bullish (from rising demand)

Last year there was NO SEPT flop and OCT was good. In 2004 BUSHITES had reason for cheer.

FED will continue to raise short term rates, flat yield curve is most reliable indicator (when long rate fall below short) of weak economy dead ahead.

Some timers called for closing all shorts at close of day, lack of bearish conviction. MOST 20 EMA declining.

D

What's Wrong With Economic Growth?

What's Wrong With Economic Growth?

by Antony Mueller

[Posted on Wednesday, August 10, 2005]

Economic growth serves as the prominent standard for measuring the performance of an economy. However, what is published as the gross domestic product (GDP) does not represent production but reports overall spending. The calculation of economic growth is based on the nominal gross domestic product deflated by a price index.

Thus, the figure for real economic growth is subject to two distortions: the indicator does not measure production but reports expenditures, and, secondly, the obtained number is dependent on the techniques that are applied to the calculation of the respective price indices.

Economic growth figures can be determined in a fairly accurate way for an economy, which is in a primitive state and when only a few, easily identifiable and compoundable items are being produced, as it is the case with basic agricultural products. In the 1950s and 1960s it was thought that tons of steel could be used as a proxy for an objective estimate of economic performance. Nowadays, the figure for GDP gets all the attention, although the basis for its calculation its actually weaker than ever before.

Economic growth had its heyday with the spread of the social gospel that it is up to the State to guarantee general welfare by managing the economy and to actively redistribute income. In this context, economic growth was conceptualized as an increase in standardized goods production, and the increase – "growth" – of the output served as the criteria for the standard of living. It was for such aims that the modern system of national income accounting with the concept of economic growth at its heart was developed, and this measurement device has never lost its link to mass production.

National income statistics and macroeconomic models use as a premise the identity between spending and production based on the tautology that sold production equals expenditures. What is being calculated here is exactly this: income and -- as its tautological counterpart -- spending. However, production itself can only be measured in goods or in units of simple services. When heterogeneous goods and complex services get produced, overall aggregation is not possible in a non-monetary form.

The calculation of economic growth in terms of "real GDP" requires deflating the nominal values of expenditures. In order to do that, the statistical offices create a basket of goods and compare the prices of the goods in this basket to the respective reference periods. But there is no objective representative basket of GDP other than as a statistical construct based on many disputable assumptions, and there is no common standard (as a tertium comparationis) which would allow the comparison of one period’s production to the other when in fact current output in terms of new, obsolete and modified goods and services is quite different from that of the past.

One does not need to resort to more extreme examples like how to measure today’s musical output and compare it in a quality-adjusted form to that of the past. The measurement problem appears also when trying to give a percentage change for the output of software programs or administrative and engineering activities, not to speak of health, legal services, and education. The statisticians may answer that the "measurement" of output is derived from expenditures. However, money prices do not measure anything. Prices only have a meaning as relative prices as they reflect the exchange ratios on the market.

As Ludwig von Mises explained, "(t)he money equivalents as used in acting and in economic calculation are money prices, i.e., exchange ratios between money and other goods and services. The prices are not measured in money; they consist in money. Prices are either prices of the past or expected prices of the future. A price is necessarily a historical fact either of the past of the future. There is nothing in prices which permits one to liken them to the measurement of physical and chemical phenomena." [1]

Adding up all sales or compounding all assets in an economy eliminates the meaning of prices. This kind of aggregation is different from what a company or a person does when calculating profits or the relative wealth position. When a person adds up the prices of his various assets, he gets a number about his current wealth relative to the price universe that he selects as his point of reference. For a company, it is sales, costs and profits that matter, and for that sound business accounting is required. Neither for personal matters nor for business decisions GDP figures are necessary. [2]

Few are aware that measuring the economy as a whole as it is intended by the GDP-concept owns its popularity to the cold war, and that its origins lie in the management of the war economies of the first half of the 20th century. [3] Before World War I, economists worked in a tradition that was mainly for peace, free trade and for limited government. Thereafter, the outlook changed. With the experience of the industrialized warfare machinery and the expansion of the welfare state, economists found their new expanding field of activity in government, and consequently the dominant philosophy of the discipline changed from laissez faire to interventionism. It was in this context that the statistical and aggregate approach to economic issues gained its momentum. [4]

The World Turned Upside Down: $20

The managers of a war economy want to measure output and its growth, because the economy is put in the service of the war aims. The central planning authorities are presumed to be aware what goods and services are needed, at which proportions the factors of production should be allocated and to whom the results of production are to be distributed. Under such conditions the increase in output of the items determined by the planners can be ranked accordingly, and economic growth, as it is measured as an increase in output, serves as the indicator of economic performance.

In a private market economy the aims of economic activity are highly diverse and represent individual and subjective valuations. For an economy that is to serve multiple private needs, the calculation of economic growth makes little sense, if any at all. One may add up nationwide the various monetary prices of the goods and services that were sold, but besides the aggregation of the monetary values of diverse items – what is the true and reliable informational value of this exercise? [5]

Each good and service has a different value for each user, and there is no common standard of value available. This is even more so the case, when new products and new kinds of services come to the market. Valuations are not only heterogeneous among persons, but also differ for the same person according to the specific circumstances. Human beings have different needs and wants in different situations, and they experience changes of taste over time. Preferences themselves are experimental devices.

Quality is not an attribute inherent to the things, but it is a valuation, which is imputed to the goods and services by the economic actor. Economic action is directed at improvement, but what constitutes improvement is subject to continuous change. Therefore, there is no objective way to measure overall wealth in aggregate form without coarse distortions and without violating the basic principles of economic valuation. [6]

It is the prerequisite of measurement that there must be identifiable objects in the measuring space and that a corresponding fixed standard of measuring unit has to be applied. Barrels of oil can be measured at the well and it can be determined how much the production has grown or not. Measurement is per definitionem quantitative. In technical terms one may measure "quality" such as that of crude oil, for example, based on its sulfur content, but this measurement is also quantitative. In this case, the measurement indicates the usefulness of that good in terms of a criteria that is derived from an industrial process.

One can determine the weight of the overall output of a certain types of steel, but one cannot in the same way come to a reasonable result by measuring in one number the aggregate production of automobiles, of refrigerators, or of personal computers – not to speak about the problems one confronts when one tries to add up the output of teachers, nurses, songwriters or software programmers together with the production of apples and oranges.

A company can count its production in terms of units of model X or T. If the company wants a figure for the total, it must resort to sales. Before sales, one can only enumerate how many units of each specific item category are on stock, and only by assuming that the company’s products will catch certain prices, is it possible to calculate the expected monetary amount -- but not the "value" of production.

Mises explained it quite clearly this way: "Prices are always money prices, and costs cannot be taken into account in economic calculation if not expressed in terms of money. If one does not resort to terms of money, costs are expressed in complex quantities of diverse goods and services to be expended for the procurement of a product." Likewise one cannot add up values or valuations. "One can add up prices expressed in terms of money, but not scales of preference." [7]

The more we move away from very basic goods, and have a more advanced and a dynamic, non-stationary economy with many heterogeneous goods and services, attempts to measure "the economy" become ever more complicated and finally these calculations lose even a rudimentary economic meaning. The concept of total output and its measurement and thus of economic growth is a statistical construct that loses its informational value for an economy characterized by a wide variety of goods and services and in which the production of new types of goods and services occurs, while many other items become obsolete.

The economy is not like one gigantic pumpkin that grows to maturity and whose size can be determined at each stage and compared from one season to the next. Also, the economy is not a cake that we all bake and then collectively consume. It is this pumpkin-like and cake-like understanding of economic activity that has provided the basis for most of the popular fallacies regarding production, distribution, and economic policy-making. [8]

For governments, using the figure for GDP as an indicator of economic performance has contributed to some of the most severe illusions of fiscal and monetary policy such as when spending for consumption is said to produce wealth or when government spending is said to boost economic growth as it happens – among others -- with military expenditures. [9]

Times of war and the preparation for it come along with high economic growth rates. Another high economic growth period was certainly the time after a pharaoh had died in ancient Egypt and the economy was put under the command to erect a new pyramid. The fascist economy of Germany in the 1930s up to the end of World War II had terrific rates of economic growth. These periods are obviously quite different from those that were experienced in Britain during the industrial revolution, or in the United States in the late 19th century, or during West Germany’s "economic miracle" after World War II.

Currently, all eyes are on China’s magical economic growth rates and by that it is put in the first league of economic performance. However, China’s economic transformation is the result of a development dictatorship. What is being measured as high economic growth rates in China is quite different from that which takes place in the periods of economic transformation when economic development is guided by free markets and based on limited government – such as it is currently the case, for example, in Ireland, and what may happen more so in the future in Eastern Europe or India.

Economic growth as it is calculated as changes of real GDP is a very crude figure. Taken at the face value its informational value is highly deceiving. While there is a wide agreement among economists that economic growth figures do not indicate well-being, their use as a measurement of economic performance is fully en vogue. Economic growth as a performance figure seduces governments and many an investor when they do not differentiate between the causes of this growth and its consequences. [10]

Modern national income accounting is the outgrowth of industrialized warfare and of the interventionist welfare state. The theoretical counterpart was delivered by modern collectivist macroeconomics with its averages and aggregates. Even as of today, economic policy is still widely guided by the propositions of these theories with their statistical constructs that are said to interact mechanically with each other in a relationship of cause and effect.

The problem with economic growth goes beyond statistics. Approaching the economic problem in terms of "growth" and "stability" is probably the most severe obstacle against understanding the true nature of economic activity as an exchange-oriented action directed at the improvement of personal conditions. Economic growth as measured by GDP directs the policy maker to the lump sum of an imaginary output instead of allowing a market driven adaptation to the diverse wants of the individuals

In the context of a non-collectivist economic theory, economic growth, as it is measured by real GDP, has no place. Likewise, in a non-collectivist economic system, the focus would not be on "stable high economic growth", but on the conditions of market exchange as the way to economic amelioration. Given that the criteria for assessing economic improvement are individual and subject to change, no guideline is adequate other than that there is an unhampered market and the protection of property rights.

In a non-collectivist economic system, the focus would not be on "stable high economic growth" as the oxymoronic expression says for the "common good" in economic policy. The individualistic economic theory focuses on the prevalent conditions of market exchange as the way to economic amelioration. In this view, what brings about improvement comes not by economic growth or by stability, but through economic transformation that is guided by the freedom of private initiative within an open market system.

The grand-scale interventions that are performed by monetary and fiscal policy in the name of growth and stability disrupt and misguide the plans for the individual, and they distort the decisions at the business level. The application of macroeconomic growth models has caused havoc when economic leaders naively adopted the interventionist creed and believe that it just takes the handling of a few economic policy instruments – like easy money or government expenditures -- to achieve the blissful state of economic plenty.

Instead of its fixation on economic growth and stability, a non-interventionist system would favor the space that is given for the individual to demonstrate and actively pursue his preferences. [11] The interventionist system, in contrast, puts the individual under a modern kind of serfdom where "output" or rather "expenditure" becomes the criteria. Economic growth puts a criterion of performance upon the individual that is detrimental to change and adaptation and to what was once called the "pursuit of happiness". Not unlike the slave masters of the past, the modern interventionist state uses its levers to push the individual by incentives and constraints towards an obscure output that is called "economic growth".

Sunday, August 28, 2005

Dollar Babble

Instead, many economists suggest an abrupt decline in the dollar's value would cause pandemonium in both U.S. credit and equity markets.

To maintain foreign interest in U.S. financial markets and prevent large investment outflows, which would disrupt the economy, the central bank would begin raising short-term rates aggressively, analysts say.

And SAT Greenie talking IT down again! http://money.cnn.com/2005/08/27/news/newsmakers/greenspan_housing.reut/index.htm

A dollar COLLAPSE not to worry? I would worry that they said that!

And to hear the Carny Barker I mean MAestro crow about housing now makes me SICK@!! As he set the stage for it and perpetuated it! NOW it's a problem because the economy is sick, he doesn;t want to raise rates but HAS to as long as housing bubble is bubbling

GOLD

Gold last made a high in 2003! $252.60

2 more subsequent moves brought us to 2 lower highs of $243.39 and $217.63 on waning momentum as shown by 3 lower peaks in RSI and MACD. Is this the chart action of a bull?

Same time we see gold bugs jumping from buildings to buy the metal. Should this occur when prices are falling?

Uptrend line from the 2000/2001 lows has been broken.

20 WK has crossed down the 50 WK, but is not decidedly declining. When it does, it will be more bearish towards gold.

But, there appears to be a double bottom at $168, should that go the I's have it. IMHO

Bullish sentiment needs to dissapear for th enext leg up to continue, remember, the last high was in 2003

Duratek

OUR DARKEST HOUR

Now Iran is scheduled to do the same by March of 2006, set up a Tehran Oil exchange where their oil will be sold ONLY in Euro's, but as well ANY nation could use exchange to sell their oil as well!

SHOULD this come about it would "displace" the US dollar as reserve currency. Now oil purchased, is paid for in US Dollars, of which need to be purchased first from the other currency. WHAT if that was reversed? Where the US Dollar had to be sold, converted into Euro's for oil?

If this would cause a weakening in the US dollar, wouldn't other world banks begin to worry about their dollar reserves?

Might those same fiats come back into this country? in enough quantities could cause runaway inflation. Remember how many fiat paper bills have been created by FED? Nearly $1 trillion in last year alone!

We already have US Treasury debt near $8 Trillion and growing as deficits remain as far as eye can see.

We have a flattening yield curve. Fed has talked this down, Fed has taken it out of its data gathering to make our economy look better!

We never had our Recession from bursting of bubble, instead we traded one asset inflation for another, the result has been growing consumer debt and a savings rate of ZERO!

China unpegged its currency to US Dollar, even more pressure and less buying.

All of this could make foreign holders stampede back here to spend the paper money before it becomes worthless! Like when CHina tried to buy CONNOCO, they were refuted. Adding no doubt to their angst, what to do then with the dollars?

When Johnny comes marching home......it will cause a HUGE rise in interest rates here to keep attracting these dollars, we need them also to fund our debt edifice.

Why would Greenspan and BLS dismiss yield curve if it has accurately predicted the last 6 Recessions?

The 2 yr and 10 yr spread is now less than .20% !!! The next FEd meeting surely carries another .25% rise.???

WHat happens when banks can't lend out money because the short rate they borrow from is higher than the longer rate they lend?

I think it probable that ALL rates rise, especially longer term notes repairing the damage of loss of profit spread.

For so long the FED allowed the birth of the carry trade, where those who could took the short money and lent it long, helping to keep long rates from rising.

We ended with, even though mainly on the coasts, a housing BUBBLE. A worldwide housing bubble.

Driving costs for first time home buyers through the roof, forcing many to use piggyback loans or interest only to qualify.

The rise in values lured "speculators" who comprise more than 25% of all homes bought! Helping to drive up prices even more so. Is all that healthy?

FEAR of WHAT drove the FED to lower rates to 1% a depression era low?

ALL those adj loans are tied to SHORT TERM RATES? and if credit card debt payment is missed in just one month, the low rates can skyrocket!

And all we could accomplish with such historic stimulus, was a normal FIB retrace of the down trend? back to a distribution trading range? where smart money has exited, adding to bagholder lemming sack?

WILL the US attack Iran to forstall the MArch exchange date? WAs it a reason they attacked Iraq? With no KNOWN ties to terrorists? and no WMD? WE did it to spread Democracy? right.......

The Bear market of the 70's was puncuated by over 40 WEEKS straight of IIAA bearsih plurality, which caused a bottom to form of historic nature. So far since 2000, we have had only 9 weeks total of this!

AS dividend yields languish at historic lows of 2% the normal 6% yields that signal bottom of bear not seen. Nor are PE ratio's.

SHOULD we IGNORE 100 years of market history? Majority of SPX profit miracle can be traced to 2 areas, finance and energy ...imagine that.

Home sales continue to rise even as Median prices paid falls. A warning that a top is imminent.

2006 is shaping up to be a HORRIBLE year for the stock markets, but if dollars come flooding back home, could be golds golden year.

And Fed is caught in their own trap, needing to keep rates HIGH to attract funds and protect dollar.

OCT 2005 wil be 6 months prior to MArch 2006 Iran oil exchange date, doesn't the market look about 6 months ahead?

Destruction of our manufacturing base, our economy essentially just a consumption black hole, NO savings to fall back on, a scramble to find yield and income, A flattening yield curve, historic debt with several bubbles to burst....I personally think we have seen the best it can be...................

And what is left is the other side of the coin, and it might be a plug nickle.

The world has foot the bill for our "recovery" be careful that foot doesn't end up in your keester.

Duratek

Saturday, August 27, 2005

FED RESERVE HISTORY thanks to Midas

When you look closely at the money in your wallet or purse, you will notice, at the top of each bill, the words “Federal Reserve Note”. What is the Federal Reserve? Most Americans cannot answer that question. This is quite understandable, as the folks at the Federal Reserve Bank do not publish much information about their activities – and for good reason. Most Americans assume the Federal Reserve Bank is a branch of Government. It is not. The Federal Reserve Bank is a private corporation, owned by foreign interests. This bank and its stockholders control the entire wealth of America.To better understand the true identity and purpose of this corporation, one must go back to the earliest days of our Nation.During the period after the Revolution, our Founding Fathers were approached by representatives of wealthy European banking families who proposed the establishment of a bank for use by America. This bank would provide the money that our young nation would need to grow into a world power. However, the Founding Fathers refused their proposal. The United States, being a sovereign nation, was fully capable of creating its own money supply. This power “to coin money and regulate the value thereof” was given to our Congress in the Constitution.Aside from knowing that the United States had the power to create its own currency, the Founding Fathers were well aware of the motives of the European bankers…. namely, to siphon off the wealth and natural resources of the people through various methods of currency manipulation, just as they had done throughout history in every major country of Europe. Thomas Jefferson expressed the prevailing attitude toward these men when he warned “If the American People ever allow private banks to control the issue of their currency… the banks and the corporations that will grow up around them will deprive the people of all prosperity until their children wake up homeless on the continent their fathers conquered”. The private European banking families, although unsuccessful in their first attempt to gain control over our currency, did not give up. During the next one hundred years, they tried on several occasions to establish their Central bank for America, but the American people, still mindful of Jefferson’s warning, quickly caught on to their paper money “tricks”, and public sentiment remained against them.Finally in 1907, a banking panic shifted public opinion against the American banking industry. The European families recognized that finally their chance to take full control of America’s banking system had arrived.Fanning the flames of public outrage toward the existing banking system, the European bankers began through the newspapers they owned and lobby groups they funded, to call for “full banking reform”. They clamored for Congressional investigations into the current banking system, and offered their expertise in drafting reforms that would protect the public future bank failures.By 1912, so widespread was public concern over banking reform that Presidential candidates from each political party offered their own carefully drafted versions of a national monetary reform bill. What the public had no way of knowing was that the two main “competing” reform bills were virtually identical, as the same German banker, Paul Warburg, wrote both. The public also had no way of knowing that the election campaigns of the three 1912 Presidential candidates were financed by Warburg’s firm (Kuhn, Loeb Company), one of the wealthiest and oldest banking houses of Europe. By controlling not only the content of the banking reform bill, but also the results of the 1912 Presidential election, the foreign banking interests were guaranteed that their dream, the establishment of a Central Bank for America (and complete control over America’s currency), would finally be realized.In 1913, the foreign banker’s Central bank plan, intentionally mis-titled “The Federal Reserve Act”, was signed into law by newly elected president Woodrow Wilson. This bill officially transferred Congress’s Constitutional duty to issue America’s currency into the hands of a private corporation, The Federal Reserve Bank of New York. Stock in this private corporation was not made available to the public, and was purchased by only the powerful banking families.At its inception, the activities of the Federal Reserve Bank were intended to be monitored by the President and Congress. However, over the years, through repeated subtle changes in legislation, the operations of this corporation have been completely independent of all Congressional control. Extremely secretive in its operation, this corporation even refuses to be audited by the United States Government.To understand how the Federal Reserve Bank has successfully transferred the wealth and resources of the mightiest nation on earth into the pockets of its privileged shareholders, it is only necessary to examine the procedure that this corporation employs to create our currency.When the management of the Federal Reserve Bank proclaims that one billion dollars should be created for use by the American people, they simply write a check for one billion dollars. By doing so, new money is thereby created out of thin air, as the Federal Reserve Bank, the creator of money, is not required to have any actual funds of its own to cover this check! With this check they then purchase one billion dollars’ worth of US Treasury Bonds from major banks and brokerage houses. The banks and brokerage houses now have one billion “new dollars” in their accounts, which they will then loan out into the economy. In exchange for the check, the Federal Reserve Bank, a private corporation with private stockholders, now owns one billion dollars’ worth of US Treasury Bonds. Wouldn’t most of us like to be able to open a checkbook with a balance of zero, write a check out for one billion dollars, then instantly have one billion dollars worth of interest-bearing Treasury Bonds placed into our account? Is it any wonder the European banking families were so persistent in their efforts to be granted the right to issue American currency?When the Federal Reserve Bank takes possession of US Treasury Bonds, it also takes control of the real wealth of America, as it is the labor and property of millions of citizens, transferred into the Treasury through taxes, that backs up the actual worth of these Treasury obligations. Each time the private corporation called the Federal Reserve Bank of New York “purchases” a billion dollars in Bonds, one billion dollars worth of American labor and prosperity must eventually be confiscated by the Treasury to “cover the check”. It may now be obvious why Thomas Jefferson so vehemently fought the issuance of America’s currency by a private bank.To add to the oppressive nature of our current money system, the Federal Reserve Bank will collect annual interest on the Treasury Bonds it holds, further adding to the indebtedness of the American citizens to the Treasury.One sometimes hears the term “debt money” used to describe the notes issued by the Federal Reserve. Under our present system of money creation, it is a sad fact that each dollar note issued by this corporation places one dollar’s worth of debt onto the backs of the American population.The effect of the Federal Reserve Bank on our Nation and its citizens has been devastating. Since 1913, the value of the American Dollar has fallen to 11 cents. Our Gold reserves have vanished. Interest rates rise and fall arbitrarily. A continually-inflated money supply wipes out the value of life-long savings. Within five years, interest payments on the national debt will exceed all revenues collected annually by the Treasury. Sadly, not one in a 100,000 Americans would be able to guess the identity of the actual group responsible for these tragic statistics.The Federal Reserve Notes in our Wallets and purses are not Constitutional money. They are in fact pieces of paper that document America’s ever-growing debt to the very clever, very persistent, and very wealthy stockholders of the Federal Reserve Bank.

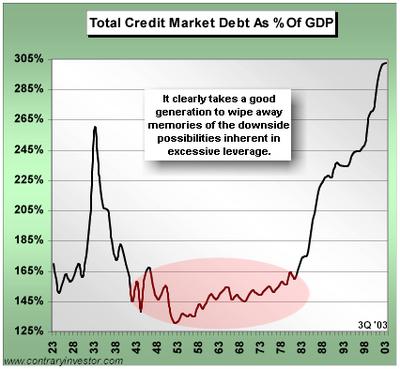

DEBT PICTURE

This is what I refer to when I speak of historic extremes.

And the flight of this trend goes along pretty good with what the stock market was able to produce.

and you see where we are now.

Duratek

SPX/VIX RATIO REVISITED

I am about the only person you will read who mentions this indicator.

I use a 20 and 50 week moving average here. LOOK how nicely the passing upward of the faster 20 wk thru the 50 wk signalled a BUY signal? How would you have faired if you followed this signal? YES.

Notice how so far, the 20 wk has managed to stay above the 50 wk? We could say that so far the trend has not been changed according to this, for now just a correction taking place.

But this is the closest the 20 has been to the 50 since its breakout, and the 2 lines are converging.

What do you think a decided breakdown of the 20 down the 50 would signal? If it was good enough for a BULL sighting, why not good enough for bear sighting? As long as it declined and stayed below the 50 wk?

Notice how both 20 and 50 wk have been rising in paralell.

If we see the reverse of this, should we not get VERY defensive? SHould we not assume Phase II of Bear Market is game on?

These are my observations and opinions, I hope you find the posting of these charts helpful as I try and master my blogs capabilities.

In 2002 there was a premature rise above 50wk, but 50 wk was still declining. In 2003 we got a divergence when the ratio made a higher low as did the SPX 500.SHortly thereafter the 20wk did its crossover thing.

We could have added other confirming TA to assist us, and should have NOT gone all in, but began to avg in our money.

I am premature perhaps looking for decline, the SPX/VIX ratio will help define my caution, and it is getting VERY close to doing so!

Duratek

Sometimes you're the bug, sometimes the windshield

A Bear sighting? When we get a 20% decline from the highs, that would give us 1775.20 as our first target, not far from 1750 2004 low.

IMHO, a breakdown from there would lead us back to the 2003 lows.

RSI is weekly overbought to neutral and MACD just giving sell signal.

Notice how from 2004 high the MACD has registered weaker peaks.

Greenspan's comments are rather curious no? Targeting housing bubble no? The shift into housing assets from stocks after 2003 lows is nothing short of amazing. The loss of this engine from economy would be nothing short of devestating, and it's coming.

Short term interest rates appear to have bottomed, hitting 4.15% retrace area we talked about, so expect a potential rise before the next decline. It may be the next decline is going to signal trouble for economy ahead.

Everybody is in the housing boat, and the iceburg somewhere dead ahead. Only subtle hints remain visable to those of us looking. Is there another bullish high awaiting for this sector? Will we end up with higher than 70% home ownership record? Can prices keep rising and rising as they have? Can we find more sub prime borrowers to ensnare?

You have the reasons for Greenspan's "unusual" remarks Friday (posted here) and yet, the market volume was weak (4th SLOWEST this year) and the VIX fear index didn't budge.

When the DOOR begins to close, there will be no room for fatty's to get through, no room for hardly anyone.

I don't want to see it my friends! But I must talk about the possibilities. I am not a party pooper or doom and gloomer, I want to alert you to what MAY come, so you can prepare and come out the other side better or no worse than you are now.

The market has gone nowhere for a year and a half, as each sector is spent, there is nothing available to drag it all forward IMHO. MAINLY because the fuel for the engine is SPENT! If you BOOM then you BUST, this is the cycle the FED seems to like and has created.

What be the signs? The markets will tell us. Breaking ABOVE or BELOW our current year plus trading range. A SHARP rise or fall in interest rates.A sharp rise in unemployment figures. a total breakdown in housing and banking index (which we will watch). A 20% DROP in the indexes from their highs (classic Bear Market signal)

Phase ONE of bear complete, cyclical Bull seems complete of almost 3 years! It is what has seperated us from Phase 2 of the Secular Bear (it would make sense that a secular bear would follow a secular bull).

What strikes me in the face is a near record string of IIAA bullish plurality of 140 weeks PLUS which covers part of the bear market, even though NO NEW HIGH has been registered in main indexes INDU SPX and NAZ.

Silver, an industrial commodity has broken below its uptrend channel, who mentions this? DO the gold bugs mention SIlver bad performance VS Gold? or that Gold has not even bettered its 2005 high yet? Maybe it does, but it hasn't and SIlver doesn't look like it would confirm that move anyway.

WHY wouldn't the metals be reflecting the INFLATION we know about? The one the BLS hides? Doesn't record petroleum bleed into every orifice of our economy as everything needs to be trucked to destination?

Fuel surcharges of 15% or more are common, it either leads to higher prices or lower profits, that and credit spread should put a capper on SX profits, and I feel going forward estimates are WAY too high, and dissapointment is dead ahead.

And we would have reached the point the obvious is obvious, and the selling will be a blood feast. We are ILL prepared for this given record LOW amounts of CASH held by Mutual Funds.

We NEVER had mass redemptions during Phase ONE of the Bear, should we get serious selling, stocks must be sold to pay redeemers.

LOTS of money has flowed into Hedge Funds some 8,000 of them, money from Institutions, and Private retirement accounts, BECUASE, Money Markets have outperformed stocks in 2005!!!! The payouts cannot be handled with current 0% or worse returns, so they figure Hedgies will do it....very risky IMHO

Even though penny stocks are pennies again, so $$$$ volume is very weak, the SHARE volume is more than doubled from its bubble 2000 peak!

Do you see now WHAT could happen in Phase II of bear? When we know for sure Hibernation is over, what kind of havoc might ensue? Because the memory of 2000-2003 will return, now it is distant forgotten memory, the VIX will again be spiking towards 40 or more rising up from recent single digits!

Record SPX/VIX ratio was hit this year, even though no new highs in Dow or SPX. The new reading was near 30% ABOVE bubble high, can you hear me now.

A rising ratio is NOT bearish in itself, as we have seen as it hit new highs of complacency, but it is when a high is IN, and then a decided decline begins and takes hold is when we get signal to be wary.

Also, as I commented many X, record credit/debt expansion is not immortal.

I am going to conclude here so I can post my last weekend chart seperate from these opinions.

Duratek

Friday, August 26, 2005

Last Half Hour Indicator

A higher top than in 2000, I felt it's turn down could be significant.

A higher top than in 2000, I felt it's turn down could be significant.

(click for larger)

This is becoming all too common place last few weeks, traders don't want to hold over the weekend, or past END of day! Unlike when they HAD to have stocks and rally into close.

37 new lows, still not over 40 and counting. 78% DOWN volume a nasty down day % wise.

JACKSON, Wyo. (AP) -- Federal Reserve Chairman Alan Greenspan on Friday cautioned Americans against thinking the value of their homes and other investments will only go higher, saying "history has not dealt kindly" with that kind of optimism.

Greenspan also said that bloated trade and budget deficits threaten the long-term health of the U.S. economy. *(wasn't HE the Rube that went along with tax cuts and lowered rates causing the bubble??)

MORE GREENBOMB

Greenspan, however, said people shouldn't count on that paper wealth, which can evaporate if economic conditions deteriorate rapidly.

"What they perceive as newly abundant liquidity can readily disappear," he said. "Any onset of increased investor caution" could cause home and stock prices to drop, he noted.

A long spell of low interest rates and low risks for investors has especially encouraged investment in homes. Greenspan worried about what would happen if that climate were to change.

Stock prices and house prices are factors that Fed policy-makers are increasingly needing to consider when setting interest-rate policy, Greenspan said. "Our forecasts and, hence, policy are becoming increasingly driven by asset price changes," he said. (end)

OIL falls, stocks fall anyway. PIXR investigated by SEC

Under Armour going IPO Do you TIVO? or dreaming of profitability.

Traders and volume should be coming off vacation soon.

Duratek

Thursday, August 25, 2005

Dr Faber

by Marc Faber

"The people that once bestowed commands, consulships, legions and all else, now concerns itself no more, and longs eagerly just for two things - bread and circuses."Juvenal made this very pertinent social observation in the first century AD, but it was another 300 years before the Roman Empire totally collapsed. Moreover, the empire experienced repeated periods of glory and power - among others under Trajan, Hadrian, and Marcus Aurelius - until its final collapse, in the fifth century, at the hands of Visigoths, Ostrogoths, and Vandals.

Despite the up-and-down nature of its fortunes, the value of its currency was in a continuous steep decline. The Denarius, which under Nero, who carried out the first debasement of the currency, still had a silver content of 94% had declined by AD 268, under Claudius Gothicus, to a negligible 0.02%!

I mention this because a recent report by my friend Peter Bernstein entitled "Cheers", begins with the following paragraph:"The prophets of gloom and doom are increasingly prolific and apocalyptic. As we admitted in our June 1 issue, this publication has contributed its fair share to this process. But the dark voices we hear are always the same dark voices, and the sheer volume and lack of variety in argument has begun to dilute their impact on us.

The sound of impending disaster is now so deafening, in fact, that we have been seeking for any rays of sunshine we could spot, if only to relieve the monotony and perhaps to find something substantive that might counter the deep pessimism flooding our mailbox.

"Peter then goes on to show in his excellent report that "the overvaluation in the stock market may be less awesome than it appeared when judged by the Shiller 10-year P/E alone, largely because of the dramatic movement in the bond market in recent months.

But there is hope in the fundamentals as well, in the CEPS [Corrected Earnings Per Share - ed. note] data and in impressive evidence from the corporate sector as a whole."Now, I suppose that Peter also had me in mind when he talked about the "prophets of gloom and doom."

However, I consider that, at least by my standards, I have in recent times been relatively cautious about expressing negative views of the U.S. stock market. This is largely because printing money, as the Romans did 2,000 years ago, enables economic policy makers to keep the party going for longer than would be possible under a rigid gold standard.

Also, I haven't quoted Peter Bernstein in order to defend my not so-rosy views about the economies of the United States and Europe, but because - unlike his mailbox - both my post mailbox and mye-mail inbox are overflowing with rather positive comments about the U.S. economy and the financial markets.

The positive sentiment and almost total absence of negative views is most apparent from investors' intelligence sentiment for stocks. Bullish sentiment remains above 50% while bearish sentiment hovers around record low readings. Moreover, since 2003 the Bulls-to- Bears Ratio has only occasionally dropped below 2.Another symptom of investors' complacency and confidence is that the volatility index for both bonds and stocks hovers near record lows - hardly a sign of excessive bearishness.

Still, Peter makes a very good point that the stock market may now be less overvalued or, as some observers will argue, even undervalued following the collapse of bond yields. At the same time, it's also true that the corporate sector is at present highly liquid. The question, however, isn't so much about the present as about the future. Are the current low interest rates sustainable?

Also, why are corporations in such a great shape financially, while the debts of the household sector have been mushrooming? Is this situation sustainable? Finally, equity prices may be reasonably priced or even inexpensive when one only takes their earnings yields compared to bond yields into account.

But, as I have tried to show in recent reports, macroeconomic, geopolitical events, natural disasters, or possibly soaring commodity prices (energy) could, some day, overwhelm in terms of importance the pure U.S. equity earnings yield and bond yield comparison and make both U.S. stocks and U.S. bonds unattractive.

In short, all the pros and cons of U.S. equities must be dealt with, and they should be compared with alternative investments, such as foreign equities and other asset classes. After all, U.S. equities could be a bargain compared to U.S. bonds, but in a world of "inflated asset values" both could conceivably be in fantasyland at the same time.PartyGaming, the owner of the world's largest online poker site, rose 11% on the day of its recent London listing.

What was remarkable was that it was the largest London IPO in five years, and following its listing (priced at 116 pence) the market value rose to almost US$9 billion. PartyGaming'sprofit growth is equally impressive. In the last three years, its pretax profits have risen from US$5.8 million to US$371.1 million. They are expected to increase to more than US$500 million in 2006. According to research by Dresdner Kleinwort Wasserstein and Global Betting and Gaming Consultants, the overall online gaming industry is expected to grow its revenues from US$9.3 billion in 2004 to close to US$19 billion in 2008.

In the meantime, in Macao, where gaming revenues now exceed those of Atlantic City, the number of tourist arrivals (mostly gamblers from China) is expected to rise from 16.7 million in 2004 to around 40 million within the next five to seven years.In the United States, taxes from casinos, slot machines at racetracks, and lotteries make up more than 10% of state revenues in Nevada, Rhode Island, South Dakota, Louisiana, and Oregon, and will shortly reach 10% in Delaware, West Virginia, Indiana, Iowa, and Mississippi. (A clinic, officially licensed by the Chinese government, for treating online gaming addictions has opened in China.

Patients are mostly aged 14 to 24 and are treated by a staff of 23 nurses and doctors. The primary cause of the patients' addiction is said to be the pressure from parents on their children to do well at school, resulting in the child turning to online gaming to relieve the pressure....)Our friend Raymond DeVoe, a veteran Wall Street watcher with loads of experience who publishes highly enjoyable commentaries with lots of insightful observations, recently described an experience he had while studying securities analysis at Columbia Business School under David Dodd (of Graham & Dodd).

For one project, Ray had to evaluate a company "that had exchanged one division for two others from another company, and placed a value of $35 million on the new acquisitions." Ray found the stock unattractive, but Professor Dodd still had a point to make. According to DeVoe, the good professor told him the following: "Mr. DeVoe, you have just made one of the most basic and common errors in security analysis, assuming something is worth what management claims it to be.

Let me tell you the story of the boy who brought home a stray dog. His father ordered him to get rid of it, but the dog remained in the house. The exasperated father finally said to get rid of it, sell it, or whatever. The boy said he would sell it for $50,000. The next day he came home and his father asked about the dog. The boy said he had gotten rid of the dog, but traded it for two $25,000 cats."Focusing on me Prof. Dodd concluded, "Mr. DeVoe, your company did the same thing, trading an almost worthless dog of a division for two overpriced cats - and then saying they were worth $35 million. Never take a management's word for the value of something without checking it yourself."DeVoe also refers to a textbook used in the statistics course - How to Lie with Statistics, by Darrell Huff.

A chapter entitled "The Mystery of the Shifting Base" explained that anything could be proven by simply shifting the base period to one that gives you the desired results.But statistics are not only faked by shifting the base; numerous other means include hedonic adjustments and fictive figures (birth-death adjustments in the employment numbers). Bill King who publishes a daily commentary on economic and financial trends, does an outstanding job of analyzing economic statistics in detail. When the May factory orders were announced on July 5, 2005 he wrote the following day,"...some pundits attribute yesterday's +2.9% reading for May factory orders as a rally cause. This is preposterous. +3% was expected, April was revised lower, to +0.7% from +0.9%. But most importantly, ex-transports, May factory orders fell 0.1%.... All day Tuesday and into last night Wall Street propagandists and the financial media extolled the factory orders numbers, even though few noted that it is down ex-aircraft orders. More importantly, we saw or heard NOONE mention that tucked into the report is the unsavory fact that inventories increased 7.5% y/y in May.I might add that while it is wonderful news that Boeing will boost its future revenues and profits with its rising order book, as well as the overall U.S. factory orders, the bad news is that Boeing's planes are increasingly becoming foreign made.So, whereas in the 1960s Boeing sourced only 2% of the content of its planes outside the United States, by the mid- 1990s this figure had grown to 30% in the case of the Boeing 777, large parts of which are manufactured in Japan. And in the case of the latest model - the 200-300-seater long haul Boeing 787, the first of a new family of aircraft - at least 70% will be built outside America - again, mostly in Japan. In the meantime, in order to reward Boeing for being one of the few successful U.S. exporters, the U.S. State Department has prepared civil charges against Boeing alleging 94 violations of the Arms Control Act because the company sold commercial airliners without obtaining an export license for a tiny gyrochip that also has defense applications. Boeing refers to the chip as "relatively unsophisticated" technology....I am fully aware that some observers will argue that it doesn't matter that U.S. companies are increasingly moving their own plants overseas or outsourcing altogether, because the improved profits that result from the outsourcing accrue to the parent company. For the valuation of that specific company and of the stock market today, this is a very good point. However, what about the long term? How beneficial is it going to be for the Western industrialized countries if IBM were to lay off 13,000 people over the next 12 months in the U.S. and Europe and hire 14,000 workers in India?Regards,Marc Faber for The Daily Reckoning

Editor's note: Dr. Marc Faber is the editor of The Gloom, Boom and Doom Report and author of Tomorrow's Gold, one of the best investment books on the market.

Charting the NDX Action

click for larger image

stochcharts.com image

It seems to me, IF 20 EMA goes under 50 EMA like before, we will get extended decline. It is just under 50 EMA, and 20 EMA held back rise as well is falling down.

Duratek

BDI chart

click for larger image

BDI and potential FIB retrace levels and support and resistance.

Thanks for reminder Jimi

Duratek

HISTORY WILL REPEAT

At the end of the day, when you mull over all the opinions, and all the comments, I look upon this chart again!

We are at the MOST EXTREME reading ever, do I need to repeat it? ALL in life revolve around cycles, and for goodness sake this cycle is LONG overdue, what I mean is th eperiod of expansion of credit as % of GDP is quickly ending its ever expanding rise. And will revert to its other cycle, credit contraction.